The company supplies a wide variety of OEMs (original equipment manufacturers). In addition to manufacturing, the company’s global services include design & engineering, systems assembly, fulfilment and after-market services. It also provides green services, such as removal of hazardous substances and waste recycling.

The company faces a massive challenge with its largest customer, Research In Motion Ltd (NASDAQ:BBRY), which contributes at least 20% of the company’s revenue, deciding to end the contract in a bid to cut costs. The company felt the impact of this development with its Q1 2013 earnings reporting a 70% drop. Further, the company posted revenues of $1.37 billion, which is a 19% fall from the first quarter figures of 2012.

It must be noted that the company realizes the need for innovation in order to sustain its earnings. Therefore, it has transformed its Toronto based manufacturing facility to develop high quality solar panels. The company has never made such a product before, however, it claims the radical innovation is the one of the best available today.

Strategic acquisitions for revenue diversification

The acquisition of Brooks Automation’s “semiconductor equipment contract manufacturing operation” during 2011 for $80 million, and the acquisition of D&H manufacturing for $70 million in 2012 clearly exhibits the company’s strategic vision on revenue diversification. It is focusing on increasing its revenues through diversified end markets, which resulted in a 27% revenue growth year-over-year.

Industry Outlook

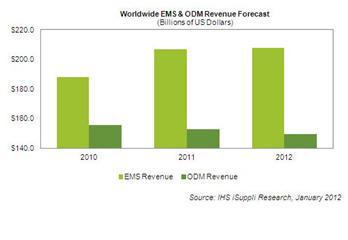

The prevalent economic crisis in Europe and the U.S. has put significant pressure on the EMS industry.

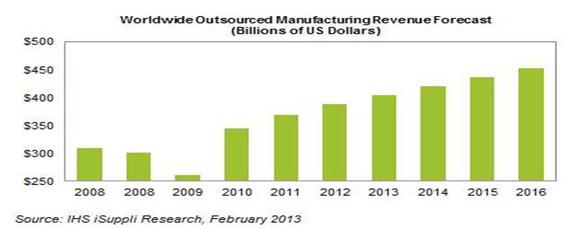

All is not lost, though, as the global electronic contract manufacturing services (CMS) market is estimated to exceed $450 billion by 2016, primarily driven by robust demand for electronic devices from emerging economies such as India, China and Brazil. This will enable EMS companies to sustain robust growth in revenue and earnings going forward.

However, intense competition in the CMS segment, particularly from China and other Asian manufacturing hubs such as Taiwan, coupled with recoiling margins, could hinder industry growth. This resulted in Celestica Inc. (USA) (NYSE:CLS)’s CEO changing the strategic direction of the company. It now plans on moving up the value chain to become a complete end-to-end supply chain solutions provider from a sole contract manufacturer.

Cut throat Competition

Celestica operates in a highly competitive environment; its major competitors are Flextronics International Ltd. (NASDAQ:FLEX), and Foxconn. Both companies are relatively larger than Celestica Inc. (USA) (NYSE:CLS) in terms of revenue.

Foxconn by far is the largest CMS company in its segment in terms of revenues. The company touched new highs during 2012, as year ending revenue crossed $100 billion, a 16% year-over-year growth rate. Apple Inc. (NASDAQ:AAPL) is Celestica Inc. (USA) (NYSE:CLS)’s largest customer, as record iPhone and IPad sales propped up Foxconn’s profits in excess of $1 billion during the fourth quarter of the previous fiscal year. Foxconn is the undisputed leader in the contract manufacturing industry with 25% share in industry-wide EMS revenue.

However, competition is now fast catching up to Foxconn with Pegatron, which derives 60% of its revenues through Apple, eyeing a share in Apple’s supply chain. Apart from the rapidly increasing competition, labor problems at Foxconn in China have further put pressure on the company’s performance.

Flextronics International Ltd. (NASDAQ:FLEX) is another key competitor to Celestica Inc. (USA) (NYSE:CLS), which finds itself on a sticky wicket with Blackberry. BlackBerry is one of its largest customers, contributing well over 10% of the company’s overall revenue. The cost-cutting initiative by BlackBerry is expected to have a huge impact on the company’s earnings in the future.

Flextronics International Ltd. (NASDAQ:FLEX) made strategic acquisitions of Stellar Microelectronics and Saturn Electronics, which added cable, solenoid, and microelectronics capabilities to its business. Additionally, divesting non-core assets and deploying new technologies gave a boost to the company’s shares, enabling it to recently clock its 52-week high of $7.39. Moving ahead, the company’s acquisition of Motorola mobility operations will further allow it to bolster its growth in the high velocity division. The company’s free cash flows of approximately $680 million will enable the company sufficient downside cushion and adequate funds to incrementally develop through its R&D.

Key takeaway for investors

The present macroeconomic environment has led to global demand falling sharply on account of the euro crisis and the U.S. economic slowdown. EMS companies are now looking to diversify into new territories, such as aerospace to defense in order to sustain growth in revenues.

Celestica is in a transitional phase, as it is focusing on moving from the high velocity low margin business to high margin business. Under the leadership of Muhlhauser, a former executive with Ford Motor Company (NYSE:F) and GE, the company is moving up the value chain.

With EMS companies, growth largely depends on the demand for its client products; hence, the current economic downturn has been extremely tough for the company. Nonetheless, as the conditions show signs of improvement and growth picks up, EMS companies are expected to report good numbers, especially with the rapidly growing demand from the APAC region.

I believe, Celestica Inc. (USA) (NYSE:CLS)’s stock is a reliable investment. Going forward, the company may stumble across a few bumps, however patient investors would be rewarded.

The article Can Celestica Transform Into a Global Supply Chain Player? originally appeared on Fool.com and is written by Kiran Gulati.

Kiran Gulati has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Kiran is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.