The company supplies a wide variety of OEMs (original equipment manufacturers). In addition to manufacturing, the company’s global services include design & engineering, systems assembly, fulfilment and after-market services. It also provides green services, such as removal of hazardous substances and waste recycling.

The company faces a massive challenge with its largest customer, Research In Motion Ltd (NASDAQ:BBRY), which contributes at least 20% of the company’s revenue, deciding to end the contract in a bid to cut costs. The company felt the impact of this development with its Q1 2013 earnings reporting a 70% drop. Further, the company posted revenues of $1.37 billion, which is a 19% fall from the first quarter figures of 2012.

It must be noted that the company realizes the need for innovation in order to sustain its earnings. Therefore, it has transformed its Toronto based manufacturing facility to develop high quality solar panels. The company has never made such a product before, however, it claims the radical innovation is the one of the best available today.

Strategic acquisitions for revenue diversification

The acquisition of Brooks Automation’s “semiconductor equipment contract manufacturing operation” during 2011 for $80 million, and the acquisition of D&H manufacturing for $70 million in 2012 clearly exhibits the company’s strategic vision on revenue diversification. It is focusing on increasing its revenues through diversified end markets, which resulted in a 27% revenue growth year-over-year.

Industry Outlook

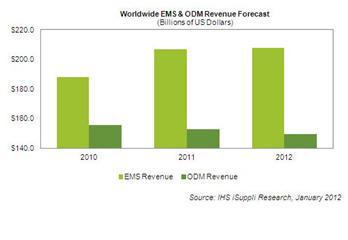

The prevalent economic crisis in Europe and the U.S. has put significant pressure on the EMS industry.

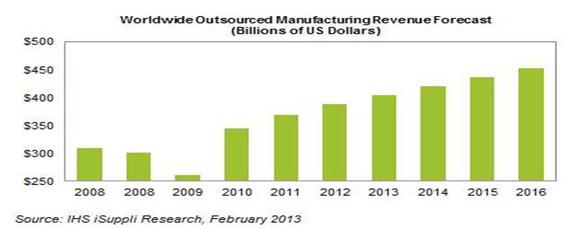

All is not lost, though, as the global electronic contract manufacturing services (CMS) market is estimated to exceed $450 billion by 2016, primarily driven by robust demand for electronic devices from emerging economies such as India, China and Brazil. This will enable EMS companies to sustain robust growth in revenue and earnings going forward.

However, intense competition in the CMS segment, particularly from China and other Asian manufacturing hubs such as Taiwan, coupled with recoiling margins, could hinder industry growth. This resulted in Celestica Inc. (USA) (NYSE:CLS)’s CEO changing the strategic direction of the company. It now plans on moving up the value chain to become a complete end-to-end supply chain solutions provider from a sole contract manufacturer.

Cut throat Competition

Celestica operates in a highly competitive environment; its major competitors are Flextronics International Ltd. (NASDAQ:FLEX), and Foxconn. Both companies are relatively larger than Celestica Inc. (USA) (NYSE:CLS) in terms of revenue.

Foxconn by far is the largest CMS company in its segment in terms of revenues. The company touched new highs during 2012, as year ending revenue crossed $100 billion, a 16% year-over-year growth rate. Apple Inc. (NASDAQ:AAPL) is Celestica Inc. (USA) (NYSE:CLS)’s largest customer, as record iPhone and IPad sales propped up Foxconn’s profits in excess of $1 billion during the fourth quarter of the previous fiscal year. Foxconn is the undisputed leader in the contract manufacturing industry with 25% share in industry-wide EMS revenue.