It’s been a great year so far for Buffalo Wild Wings (NASDAQ:BWLD). The company’s shares have increased over 40% since January just as Buffalo Wild Wings (NASDAQ:BWLD) has turned in some very favorable earnings reports. Last quarter, the company’s net income was up 41% year over year. But even with the impressive start to this year, there is plenty of reason to believe 2013 can still hold some sizzle.

Football season

The biggest time of year for this company is undoubtedly football season. Buffalo Wild Wings (NASDAQ:BWLD)’ revenue consistently tapers in the summer before spiking to new all-time highs in the fall and winter.

BWLD Revenue Quarterly data by YCharts

It’s no secret that chicken wings are the perfect companion to football. That’s why the timing of McDonald’s Corporation (NYSE:MCD) “Mighty Wings” launch is no surprise. Football season officially kicks off with Thursday Night Football on September 5. Mighty Wings debut on September 9 — the same day as Monday Night Football’s start. McDonald’s Corporation (NYSE:MCD) chicken wings will be available only through November — or the majority of football season.

Football season is quintessential for chicken wings, but while McDonald’s Corporation (NYSE:MCD) looks to boost lackluster comp-sales through limited-time menu offerings, chicken wings are Buffalo Wild Wings (NASDAQ:BWLD)’ bread and butter. Chicken wings — both traditional and boneless — made up 39% of this company’s sales last quarter.

The lure of Buffalo’s restaurants is watching the game — whatever game it is — and taking advantage of the big flat-screen TVs, good food, and beer. In keeping with the trend, the company’s revenue should spike once the NFL season starts. The NFL remains immensely popular in the US, accounting for 24 of the top 25 most- watched TV shows in 2012.

Chicken prices

One major weakness for Buffalo Wild Wings (NASDAQ:BWLD) is its dependency on chicken wing sales, considering that the company does not hedge wing costs. The company has always paid the real-time market price for wings, which hurt its profits last year as the US drought took hold and wing prices spiked from just $0.90/pound in 2011 to over $2.00/pound. The bulk of this inflation occurred so fast that new menu prices couldn’t be rolled out in time. Unfortunately for the company, this spike coincided with football season.

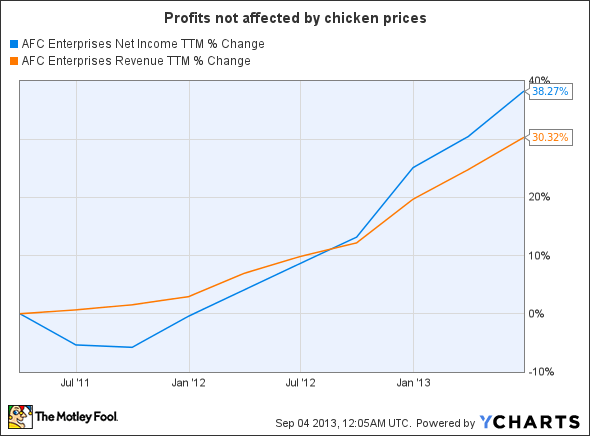

Commodity contracts are quite common and are one of the things that has helped AFC Enterprises, Inc. (NASDAQ:AFCE) on its way to higher profits. This parent company to Popeye’s Louisiana Kitchen was not crippled by high chicken prices, despite chicken accounting for 40% of sales.

AFCE Net Income TTM data by YCharts