To say that higher education in America is hurting would be an understatement. Big brother-like investigations and regulations from the US Government, huge enrollment drops, increasing default rates, student loan debt exceeding $1 trillion, lawsuits abounding, undercuts in pricing from subsidized public colleges, competition from new learning technology called MOOCs, and a majority view that mixing profits with education is unethical have all combined to make the for-profit education industry arguably the most unloved industry of any group of publicly-traded companies.

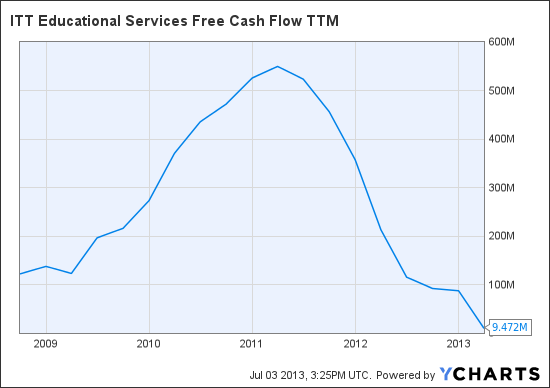

They’re also arguably the cheapest. Bridgepoint Education Inc (NYSE:BPI), an almost exclusively online educator in the middle of accreditation and legal battles, sells for 6.7 times free cash flow and that’s not even including the companies $400 million cash hoard with no debt. Industry leader Apollo Group Inc (NASDAQ:APOL), whose University of Phoenix was recently placed on probation and has experienced unusually high enrollment drops, is on sale for 5 times free cash flow with $900 million cash and hardly any debt. ITT Educational Services, Inc. (NYSE:ESI), an urban campus-based technical educator, was bringing in over $500 million just a few years ago and now sells for that same amount.

ESI Free Cash Flow TTM data by YCharts

I’ve done extensive research on Bridgepoint and find the stock to be an ideal arbitrage play. Play that cash. The sooner the general market recognizes that cash, the soonor you’ll see price appreciation. In the past, Bridgepoint Education Inc (NYSE:BPI) has been an effective competitor in online education because of an industry-leading cost structure and tuition prices that minimized Title IV Aid dependence. The company is now under pressure from accreditors to move corporate HQ out of California, closer to where Ashford University is located. Though such a move would certainly take a bite out of the company’s cash hoard, it would likely solve the accreditation issue and further lower costs with more synergy between corporate and Ashford. It bothers me that management didn’t solve this issue already and make the move to prevent it from becoming a bigger issue, but I think Bridgepoint Education Inc (NYSE:BPI) is still a good buy.

Apollo Group Inc (NASDAQ:APOL) concerns me the most of the three because enrollments are trending the worst, the valuation isn’t as great, and University of Phoenix is on probation. It seems to me that accreditors are trying to make an example of Apollo since it is the industry leader. I do like the initiatives to close all those campuses though. Apollo has one of the most expansive cost-cutting plans. Probation is dangerous, but the company has a good deal of time to fix the issues before accreditation is actually lost.

None of these companies have to make the money they used to in the future to make them good buys now. Even if they can recover FCF to half their previous peaks, very reasonable for many, shareholders will be rewarded tremendously.

If you think as I do, that these companies present compelling value, act now. Most people take the following stance when considering whether to invest in for-profits now: “I’m going to let the dust settle and all the uncertainty clear up before I go long. It’s just too risky now.” I was enlightened recently reading The Most Important Thing by Howard Marks. He says the following which is very relevant to this situation:

Certain common threads run through the best investments I’ve witnessed. They’re usually contrarian, challenging and uncomfortable – although the experienced contrarian takes comfort from his or her position outside the herd. Whenever the debt market collapses, for example, most people say, ‘We’re not going to try to catch a falling knife; it’s too dangerous.’ They usually add, ‘We’re going to wait until the dust settles and the uncertainty is resolved.’ What they mean, of course, is that they’re frightened and unsure of what to do. The one thing I’m sure of is that by the time the knife has stopped falling, the dust has settled and the uncertainty has been resolved, there’ll be no great bargains left. When buying something has become comfortable again, it’s price will no longer be so low that it’s a great bargain. Thus a hugely profitable investment that doesn’t begin with discomfort is usually an oxymoron.

I noticed many of these companies just a few months ago and they were substantially cheaper. ITT Educational Services, Inc. (NYSE:ESI) was trading for $14.25 when I found it in January. Now it’s at $24.05. As ‘the dust settles’ these companies are going to keep appreciating. Some may not survive but those who do won’t be found anywhere near as cheap as they are now. If you find a company that you feel confident will survive the coming shakeout and think the present price presents a favorable risk-reward, then act now. That’s what investing is all about. We accept that the future is uncertain and seek optimal compensation for bearing that uncertainty. The risks of investing in for-profits will never be eliminated, but right now investing in them will be rewarded more than bearing the same risk in the near future. I advise you to do your own thorough research in picking a company. Look for low cohort default rates, accreditation security, new student start growth, low debt, lots of cash, and stabilizing free cash flow. I’ve looked at many for-profits and I can tell you that the opportunities are there, you just need to act on your convictions.

The article Now Is the Time to Invest in Education originally appeared on Fool.com and is written by Brian Grosso.

Brian Grosso has no position in any stocks mentioned. The Motley Fool recommends Bridgepoint Education. The Motley Fool owns shares of Bridgepoint Education. Brian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.