Julian Robertson was one of the prime forces that helped nurture the hedge fund industry in the United States. In addition to his efforts in building the industry, he ensured that the industry would have many talented hedge fund managers for years to come, which are now known as ‘Tiger Cubs’. Stephen Mandel is one of these tiger cubs, and his hedge fund, Lone Pine Capital, has filed its 13F for the June 30 reporting period. According to Forbes’ Real Time Net Worth list, Mandel has a net worth of $2.3 billion as of the reporting period and ranks 284 on the list of billionaires in the United States. His investment firm has more than $30 billion in assets under management and its 13F filing disclosed a public equity portfolio containing holdings valued at $26.73 billion. Consumer discretionary and information technology are among the sectors attracting the majority of Mandel’s investments. Illumina, Inc. (NASDAQ:ILMN), Microsoft Corporation (NASDAQ:MSFT), and Charter Communications, Inc. (NASDAQ:CHTR) are the equity investments in Lone Pine Capital’s portfolio which the manager added massively to during the second quarter, and we’ll take a look at these stocks in this article.

Why are we interested in the 13F filings of a select group of hedge funds? We use these filings to determine the top 15 small-cap stocks held by these elite funds based on 16 years of research that showed their top small-cap picks are much more profitable than both their large-cap stocks and the broader market as a whole. These small-cap stocks beat the S&P 500 Total Return Index by an average of nearly one percentage point per month in our backtests, which were conducted over the period of 1999 to 2012. Moreover, since the beginning of forward testing from August 2012, the strategy worked just as our research predicted, outperforming the market every year and returning 118% over the last 35 months, which is more than 60 percentage points higher than the returns of the S&P 500 ETF (SPY) (see more details).

Follow Stephen Frank Mandel Jr.'s Lone Pine Capital

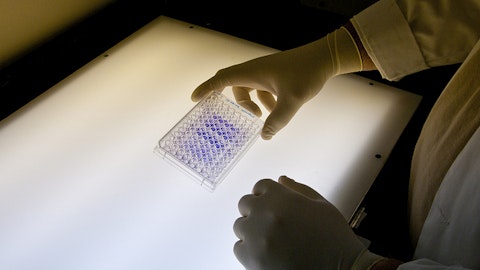

Stephen Mandel has enhanced his position in Illumina, Inc. (NASDAQ:ILMN) by 96% in comparison with the previous reporting period, lifting it to 5.68 million shares valued at $1.24 billion. The company excels in providing genetic analysis solutions to its clientele and its shares have grown by 11.69% year-to-date. The genomic sequencing firm reported strong second quarter 2015 earnings of non-GAAP earnings of $0.80 per diluted share against Wall Streets’ estimate of $0.78. However, its revenue fell short of the analysts’ estimate of $541.8 million with reported quarterly revenue of $539.4 million, leading to a decline of 10% in its share price the next day. Despite negative investor sentiment, there were some positive takeaways from the report, including 21% year-over-year growth in its revenue along with a 40% increase in its year-over-year EPS. Andreas Halvorsen’s Viking Global Investors is among the primary shareholders of the company with a reported stake of $1.09 billion in the company at the end of the second quarter, holding 4.97 million shares.