When it comes to banks to invest in for the long-run, few of the big banks fit the traditional criteria of what investors look for: stability, low-risk assets, good dividend yield, and a good record of growth. One bank that even after the financial crisis still meets those criteria is BB&T Corporation (NYSE:BBT). With the recent rejection of the company’s capital plan by the Federal Reserve and the slight dip in share price at a time when most financial stocks seem to be hitting new highs daily, BB&T may be worth a look for your portfolio.

About BB&T Corporation (NYSE:BBT)

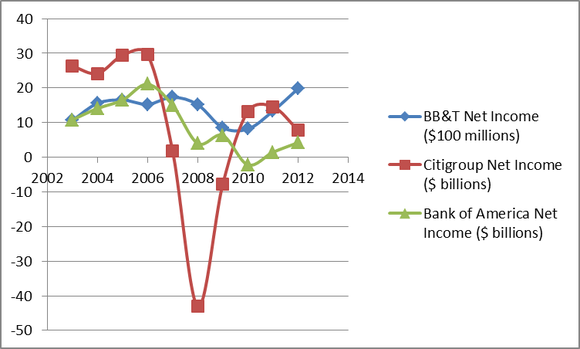

With assets of about $184 billion, BB&T is the 11th largest U.S. bank, operating mostly in the Southeast U.S. After a small dip as a result of the financial crisis, BB&T has grown its income to its highest level ever, without any losing years. Compare that to the performance of Citigroup Inc. (NYSE:C) and Bank of America Corp. (NYSE:BAC), who both took on considerably more risk than BB&T and paid the price for it when things got rough.

The above chart says one thing about BB&T as opposed to its bigger rivals: it is stable. As a result of its stability and better-than-average credit quality, it was able to capitalize on the misfortune of some weaker competitors and greatly strengthen and expand its presence in recent years.

Why BB&T is Stronger than Before the Crisis

First, in December 2008, BB&T Corporation (NYSE:BBT) purchased the assets of Haven Trust Bank, a small Georgia bank that had been closed by the FDIC. Then, BB&T made a larger move and acquired most of the assets of Colonial Bank, with 357 offices in Alabama, Florida, Georgia, Texas, and Nevada. This greatly improved BB&T’s market share in Florida and Alabama. Most recently, in 2012, BB&T acquired BankAtlantic Bank in Florida, which added 78 branches and $3.3 billion in deposits. It is because of savvy acquisitions like these that BB&T has been able to drastically increase its assets since before the crisis (see chart).

BB&T’s Capital Plan Drama

In a surprising move to most analysts and investors, the Fed rejected BB&T Corporation (NYSE:BBT)’s capital plan despite the fact that it was determined that BB&T would pass the government’s stress test. There is no clear reason for the rejection, and thus far both the Fed and the bank are being quiet about it. BB&T is one of the most well-capitalized banks in the country, which has led to speculation that the failure was a result of a qualitative issue such as flawed corporate governance or supervisory issues.

Regardless, this puts on hold the plans by BB&T for share buybacks and further dividend increases. They will resubmit the plan by the end of the 3rd quarter, and I foresee no major issues in gaining approval. I have full confidence that they will correct whatever was wrong, and will be able to put this behind them. Once their capital plan is improved, investors should get a nice pop in the share price from the news.