While vehicle sales in the U.S. continue to remain strong, driven by a robust housing sector and low interest rates, it’s surprising to see that the average age of vehicles on U.S. roads has continued to increase. According to market research firm Polk (via CNN Money), the average age of vehicles has hit an all-time high of 11.4 years.

The firm is of the opinion that tepid sales of new vehicles during the recession has led to an increase in the average age, and the number of vehicles more than 12 years old on the road is growing at a fast pace. After taking a look at this piece of data, one shouldn’t be surprised at the terrific performance of aftermarket retailers this year, especially O’Reilly Automotive Inc (NASDAQ:ORLY).

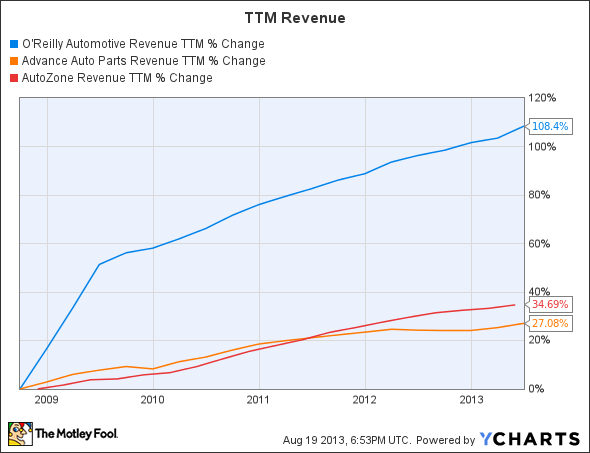

This massive outperformance when compared to its peers doesn’t come as a surprise when O’Reilly Automotive Inc (NASDAQ:ORLY)’s revenue growth is compared to theirs.

ORLY Revenue TTM data by YCharts.

Solid yet again

In the recently reported second quarter as well, O’Reilly Automotive Inc (NASDAQ:ORLY)’s revenue grew almost 10% from the year-ago period to $1.71 billion, surpassing the $1.70 billion consensus. Same-store sales growth in the quarter was very impressive. O’Reilly exceeded its own target of 4% to 6% by clocking same-store sales growth of 6.5%, way better than the 2.5% it witnessed last year.

Earnings growth was even more spectacular, as earnings per share shot up 37% to $1.58, comfortably ahead of the $1.49 consensus estimate. O’Reilly’s efforts at increasing its margins by way of selling more high-margin items seem to be bearing fruit.

Looking ahead, O’Reilly is looking to benefit from the higher average age of vehicles on the road. Management believes that the complexity of vehicles, the higher costs of parts, and the longer average vehicle life due to better engineering will be tailwinds going forward. In addition, O’Reilly Automotive Inc (NASDAQ:ORLY) is of the opinion that consumers have some good reasons to keep their older vehicles running.

With unemployment rates still being a concern, O’Reilly is of the opinion that consumers are still facing short-term economic uncertainty. So, consumers might still be keen on keeping their older vehicles running, and this would require maintenance, which bodes well for O’Reilly. With more than 4,000 stores, O’Reilly looks well-positioned to benefit from this trend of maintaining older vehicles for long periods of time.

Strategies to watch

The company has initiated a loyalty program to further boost sales as it looks to capture more do-it-yourself customers, by way of targeted promotions and accumulating purchasing history of consumers. O’Reilly has received positive feedback regarding its loyalty program in the pilot phase and plans to implement it across its chain by the end of the fiscal year.

To expand its presence further, O’Reilly acquired VIP Parts, Tires & Service’s parts business last year, adding 56 stores to its portfolio in Maine, New Hampshire, and Massachusetts. Although O’Reilly doesn’t expect immediate accretion from this acquisition, the company aims to expand its footprints in these markets, and VIP’s acquisition provides it with a point of entry.

O’Reilly also opened 10 new stores in California and it is looking to penetrate this region further, along with other western markets. The company is also focused on expanding its distribution centers in order to provide merchandise to its stores in a fast and efficient manner. O’Reilly recently opened a distribution center in Chicago and it is constructing another one in Lakeland, Fla.

The pick of the lot

These strategies should help the company maintain its robust same-store sale growth going forward and also its lead over peers. In fact, O’Reilly has been delivering better comp growth than both AutoZone and Advance Auto. In the previous quarter, Advance Auto’s same-store sales actually declined 0.3% from the year-ago period. Similarly, AutoZone had witnessed a decline of 0.1% in same-store sales as well.

Hence, it shouldn’t be surprising that O’Reilly has a premium valuation as well. It trades for almost 23 times trailing earnings, while AutoZone and Advance Auto trade at a similar 16 times earnings. Advance Auto has been gradually improving its business, as its same-store sales decline in the previous quarter was better than a decline of 2.7% in the year-ago period.

Advance Auto looks like the next best option in the sector after O’Reilly, as the company seems to be turning around and has been expanding at a fast pace. Its acquisition of BWP earlier this year, a company that supplies aftermarket products to commercial customers, has netted it 124 stores that have been successfully integrated, according to management. The company is also expanding its hub stores to penetrate local markets, and it took its hub count to 354 in the previous quarter, an increase of 34 hubs from last year.

AutoZone is also making some good moves and plans to open 300 stores in the ongoing fiscal year. The largest auto-parts retailer in the U.S. is also looking at further growth in its commercial business, which is underpenetrated, as 68% of its stores presently run a commercial program.

However, the company’s debt is a concern when compared to the other two. It had $4 billion in debt at the end of the last quarter and generated $385 million in operating cash flow, and used $325 million for buying back shares. Its book value per share is also negative while both Advance Auto’s and O’Reilly’s book values are around $18.50 per share.

The bottom line

Despite higher sales of new cars, aftermarket retailers have done very well this year and O’Reilly Automotive Inc (NASDAQ:ORLY) is the pick of the lot. It is witnessing robust growth in same-store sales and earnings, and is focused on gaining more business through strategies discussed above. O’Reilly is benefiting from the growth of the industry and its moves should help it stay ahead of its peers.

The article This May Be the Best Aftermarket Retailer You Can Buy originally appeared on Fool.com.

Fool contributor Harsh Chauhan has no position in any stocks mentioned. The Motley Fool owns shares of O’Reilly Automotive.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.