Do you like companies that pay generous dividends? How about firms with high barriers of entry that enjoy enormous pricing power and operate in a duopolistic industry? If you answered yes to one or all of the above, AT&T Inc. (NYSE:T) could be a perfect fit for your portfolio.

A dividend stalwart

AT&T Inc. (NYSE:T) and competitor, Verizon Communications Inc. (NYSE:VZ), share around 65% of the market share for mobile subscribers in the United States. This dominance allows both firms to enjoy enormous pricing power because, let’s face it, people will pay up before they will give up their smartphones and internet connections. This makes these two telecom giants nearly recession-proof as well.

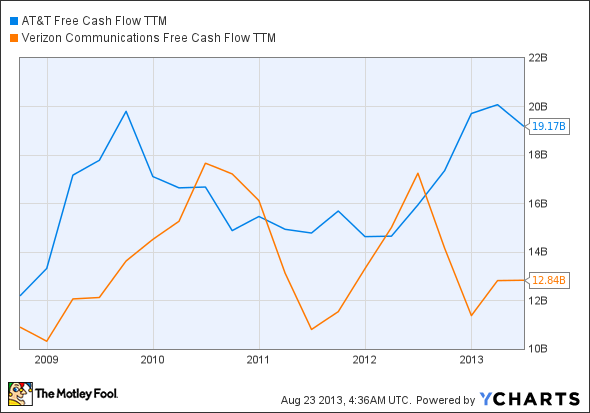

AT&T Inc. (NYSE:T)’s 5% dividend yield easily beats out Verizon Communications Inc. (NYSE:VZ)’s yield of a little over 4%. These dividends have been increasing for decades, including through the Great Recession, and are supported by large amounts of free cash flow.

T Free Cash Flow TTM data by YCharts

What’s up with all that debt?

The telecommunications industry is capital-intensive, especially when in the middle of rolling-out the next generation wireless 4G LTE network, which costs a pretty penny in the short-term, but leads to more customers down the road. The newest 4G technology can be up to ten times as fast as the old 3G wireless technology, which is why AT&T Inc. (NYSE:T) and Verizon Communications Inc. (NYSE:VZ) are aggressively expanding it nationwide.

AT&T’s debt load of around $76 billion, compared to only $4.55 billion in cash, is likely due to heavy investment into the future, and expenditures should inevitably die down. The company’s ability to generate billions of free cash flow also give it more maneuverability. Verizon Communications Inc. (NYSE:VZ) carries almost $50 billion in debt, with $2.41 billion in cash on the books, so AT&T Inc. (NYSE:T) isn’t racking up debt all by itself either.

Debt is a necessary evil for companies constantly needing to reinvest in upgrading their networks. While AT&T is rapidly expanding its 4G LTE network, which covers more than 225 million people in 370 markets, it still lags behind Verizon Communications Inc. (NYSE:VZ), which covers over 500 markets and engulfs nearly 95% of the U.S. population. Verizon has nearly finished its roll-out, however, and AT&T has plans to eventually match the size and scope of its competitor.

A new threat emerging

Who would have thought that Google Inc (NASDAQ:GOOG) would, once again, disrupt the old way of doing things? Google Fiber, one of the Mountainview giant’s new pet projects, is an affordable, fast, and free internet service. In the short-term, AT&T and Verizon may not be very concerned, considering it would cost Google an estimated $140 billion to cover the entire nation with its own service. Long-term, however, things could be different.

For instance, after allowing AT&T to provide its in-house, free Wi-Fi since 2009, Starbucks has had a change of heart, deciding to get more cozy with Google Inc (NASDAQ:GOOG). Google will now step in front of AT&T for the opportunity to build out the fast-growing Starbucks network in the future. Over the next 18 months, Google will be upgrading over 7,000 Starbucks locations in the U.S. That’s a big loss for AT&T, and could result in a troubling longer-term issue if Google continues to steal customers.

Google Inc (NASDAQ:GOOG) Fiber is offered in approximately a dozen cities nationwide, but it would be very costly for it to become a real threat to established telecommunications companies any time soon. It’s unrealistic to assume that Google Inc (NASDAQ:GOOG) will drop hundreds of billions of dollars in an attempt to take out AT&T and Verizon, especially when the search-giant makes almost all of its revenue from advertising.

International expansion

U.S. telecommunications companies are largely domestic players, but could benefit in the future from international growth. It’s been rumored that AT&T wants to expand into Europe. Verizon rumors center around a 50/50 chance that it will enter into the Canadian market, according to Bloomberg. However, Verizon’s entry into Canada would also be costly. Moody’s estimated a cost of $3 billion just for the company to get up and running north of the border. The question is whether or not the new markets and growth are worth the price and effort.

AT&T is doing the opposite of Verizon and looking south of the border. The company owns a stake in America Movil S.A.B. de C.V., which gives it exposure to 18 lucrative and growing markets in the Americas, including Mexico. AT&T holds approximately 9% of the company, so this asset not only lets it benefit from emerging South American economies, but also allows it to sell shares if the stake gets too large. AT&T recently re-balanced its stake, making a cool $564 million in the process.

Expanding into Europe would give AT&T an escape route from saturated U.S. markets, but in the meantime, it will have to rely on its exposure to Mexico and South American growth markets.

The bottom line

AT&T is a steady stalwart that provides an increasing, high-yielding dividend, perfect for generating income. Growth may be slow, but when its 4G LTE network is complete, costs should go down and earnings should increase along with free cash flow. AT&T will continue to profit from the wireless revolution and is attractively valued. Besides offering a higher dividend than Verizon, AT&T is also cheaper in relation to earnings, trading at only 12.5 times forward earnings. Verizon carries a forward P/E of over 14.

The article Generate Income With This Telecom King originally appeared on Fool.com and is written by Joseph Harry.

Joseph Harry owns shares of AT&T. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.