As RIMM’s BlackBerry becomes more uncompetitive there is a long road to recovery, and support for the stock at this point appears to be driven by a possible take-over or break-up of the company. A turnaround, if possible, would take years at best. Analysts estimate this year’s full year earnings will come in down 136% from last fiscal year at negative $1.51 a share, and next fiscal year to come in at negative $0.62.

The company traded around $50 from mid-2009 to early 2011. In the time since, earnings have been shoddy, and shares have declined to around $6.50. RIMM is down 55% year to date.

One of the company’s biggest competitors, Apple Inc. (NASDAQ:AAPL), recorded 3Q revenue of $35 billion, up 23% year over year, and full year revenue is expected to be up 50% from 2011. Apple just launched its new iPhone 5 and is expected to sell 25 million iPhones in fiscal 4Q 2012, which includes 8-9 million iPhone 5 units.

Google Inc. (NASDAQ:GOOG), the current leader in the smartphone market share race, has ramped up spending to spur innovation in mobile and mobile search. Google hired 1,200 new employees in 2Q 2012, and the Motorola acquisition brought with it another 20,300 employees. The adoption of Google’s Android mobile operating system continues to be impressive, with 1 million handsets activated daily. Google reported 2Q results, missing the consensus EPS estimate by $0.03 or 0.3%, but gross revenue rose 35% year-over-year to $12.21 billion and excludes Motorola revenues.

Nokia Corporation (NYSE:NOK) introduced its new Lumia phone that runs the Windows Phone 8 operating system created by Microsoft Corporation (NASDAQ:MSFT). However, this is not an exclusive deal, as Google’s Motorola, HTC and Samsung all plan to introduce Windows 8 phones. Nokia does have a lot riding on its Windows 8 phone and is taking Apple head on. Nokia saw a 9% revenue decline in 2011 and analysts estimate a 19% decrease in 2012, and handset volume is expected to be down 18%. Nokia has seen its 40% plus ownership of the mobile phone market from a decade ago decline rapidly to less than 20% of mobile phones at present levels. The smartphone market provides even worse prospects for Nokia, who owns less than 5% of that market.

For 2Q, Microsoft announced its entertainment & devices division had revenue growth of 7.6% for its latest fiscal year, ended in June. The entertainment division was 13% of Microsoft’s total revenue and includes the Windows Phone and Skype, as well as the Xbox 360. Unlike its primary competitors, Microsoft does have more tactful advantages when it comes to gaining smartphone market share.

All of these companies show no signs of letting up when it comes to tearing down RIMM’s handset business, offering a combination of other features in addition to just a smartphone. The smartphone market has grown 58% over the last five years and changed greatly over this time; ComScore puts the smartphone market share at: Google Inc 52.2%, Apple Inc. 33.4%, RIMM 9.5% and Nokia 3%.

Stacking these companies up against each other: RIMM and Nokia both trade well below the others on a multiples basis, mainly indicative of their demise as major competitors in the smartphone market. Microsoft trades at a P/E of 16 and a P/S of 3.6, Apple at 17 P/E and 4.4 P/S and Google at 22 P/E and 5.6 P/S, while RIMM and Nokia both have an incalculable P/E due to negative earnings and a P/S of 0.2.

It would appear many funds felt burned after RIMM first slipped during the second quarter of 2011. Funds who were owners of RIMM during 1Q 2011, before the start of RIMM’s steep decline, were names such as Bill Miller, Bain Capital, Ken Griffin, Steven Cohen and D.E. Shaw. Once the decline began in 2Q 2011, Jim Simons took a new position and Ken Griffin upped his by 68% – buying into the potential opportunity that RIMM was oversold. As well, Israel Englander and Ray Dalio upped their positions.

Most notably, of those funds buying into RIMM during 2Q 2011 were Prem Watsa of Fairfax Financial Holdings. Fairfax took an entirely new position of 8.3 million shares that made up 8% of the firm’s 2Q 2011 13F portfolio. As of 2Q 2012, Fairfax had increased their position to 26.8 million shares, which was 10.4% of their 13F holdings.

As RIMM slipped below $10 during the second quarter of this year, the action from funds was mild. Jim Simons kept his position relatively stable at 7 million shares, as did Coature Management, but Ken Griffin at Citadel Investment Group increased his position by 170%. Other firms who continue to own shares are D.E. Shaw, Steven Cohen and Israel Englander.

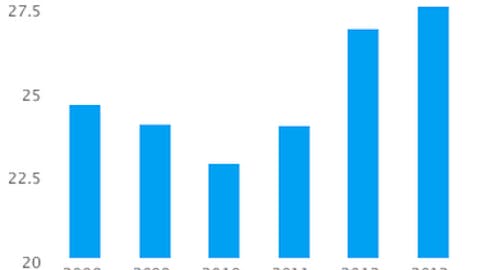

Our question becomes, what are the funds that currently own RIMM holding on for? Admittedly, the stock cannot go much lower before hitting zero, but we struggle to find which company might be interested in buying RIMM at current levels. The benefits for one of its competitors, besides RIMM’s relatively large subscriber base and patent portfolio, are hard to see given the company does not appear to be a current threat. All of its competitors could easily purchase RIMM should they choose. As of the second quarter, Apple had $28 billion in cash and short-term investments, while Microsoft had $63 billion, Google $43 billion, and even Nokia had $10 billion. RIMM’s market cap is only $3.4 billion.