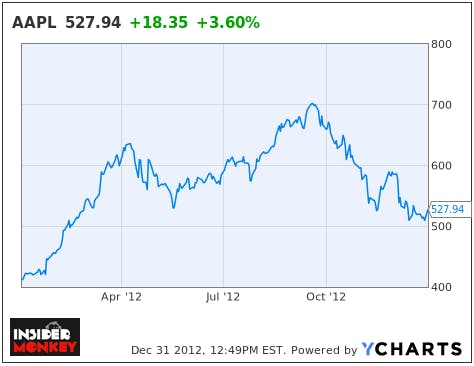

Apple Inc. (NASDAQ:AAPL) is up over 3% on the last day of 2012, and opinions are mixed on what the stock will bring in 2013. Uncertainty over future product offerings and worries of increasing competition from Google are a couple of the most widely held beliefs of the bears. On the bright side, though, there are plenty of reasons to be excited about Apple’s prospects, and it all starts with the valuation.

Apple Inc. (NASDAQ:AAPL) quote: YCharts

On CNBC earlier today, Channing Smith, co-portfolio manager of the Capital Advisors Growth Fund, was discussing his Apple Inc. (NASDAQ:AAPL) sentiment, which is particularly bullish. According the the broadcast, Apple is the second largest holding in Smith’s fund, worth close to 5% of his total portfolio. Smith mentioned that he “cut it back a couple months ago, but […] recently added to the position,” adding that:

“If you look at Apple’s stock earlier in the fall, we think investors might have gotten a little overly optimistic on the prospects for the holiday quarter. Today you have the opposite situation where investors are overly pessimistic. We’re on the cusp of an enormous product upgrade cycle, and we think Apple’s earnings are going to be dynamite in the fourth quarter [fiscal first quarter].”

On the worry that margins are shrinking, Smith mentioned that “if you look back at Apple’s history, what you’ll see when you see product introductions, is that gross margins go down […] what you’ll see after […] is that gross margins will start to accelerate, and that’s when investors want to buy the stock.”

But that’s not all the PM had to say about Apple Inc. (NASDAQ:AAPL).

Regarding Apple Inc. (NASDAQ:AAPL)’s valuation specifically, Smith shared the following:

“This stock is at 10 times [earnings], should grow earnings by 20% over the coming years, and it trades at a 20% discount to the S&P. It just doesn’t make sense […] We think that there’s tremendous growth in these categories and that earnings are going to surprise on the upside come January”

We’d like to add one other metric to the discussion: the PEG ratio. Short for price earnings-growth, this ratio determines how investors are valuing a stock’s growth prospects. Shares of Apple currently trade at a PEG of 0.59; typically any figure below 1.0 signals an undervaluation. In comparison to its peers, Apple is also cheap, as Google (1.4) and Microsoft (1.5) are more than twice as expensive.

Still, there are always two sides to every argument; let us know how you’re trading the stock in the comments section below. For more Apple Inc. (NASDAQ:AAPL) coverage, continue reading here:

Wall Street’s Apple Analysts are ‘Out of Whack’: Study