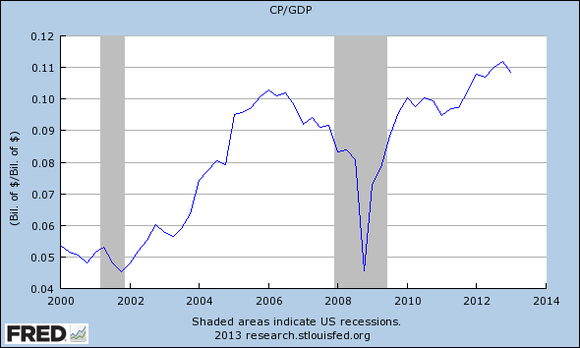

At the most basic level, a share of stock entitles you to a share of profits — and profits are what ultimately bolster a stock price. Recently, profits have been at all-time highs — not only nominally, but as a percentage of GDP. Some observers believe this trend is unsustainable and that corporate profits will revert to their historical mean. And if profits do fall and revert to the mean, stock prices will fall as well.

Why does all this matter right now? Because profits this past quarter just fell by a significant amount.

The numbers

As a percentage of GDP, corporate profits have averaged 6.2% of GDP since 1947. Today, they hover around 11%. Against the recent upward trend, however, the latest quarter’s profit numbers have fallen. Corporate profits after tax dropped 2% from the fourth quarter of 2012. That’s the biggest drop since the first quarter of 2011, a year when the S&P 500 ended flat. The difference now, though, is that profits are even higher and have further to fall if they do revert.

Some commentators argue that there’s been a fundamental change in our economy’s structure and that corporate profits won’t necessarily return to that historical mean. That is, innovations such as computers and the Internet help companies book more profit than they could in the past.

As James Surowiecki of The New Yorker writes:

The underlying issue is that in recent decades there’s been a shift in the U.S. economy: It’s become far more congenial to businesses and investors. The fundamental trends that have driven the profit boom are unlikely to be reversed.

The changes he highlights are historically low corporate taxes, American companies that are grabbing profits overseas, and a weak labor market.

Of course, there are counterarguments to each of those points.

Corporate tax hounding

Surowiecki notes:

In 1951, corporations had to pay almost half of reported profits in taxes. In 1965, they had to pay more than thirty per cent. Today, they pay only around twenty per cent.

And now, with fewer taxes from corporations, governments strain to stay afloat. Stockton, Calif., declares bankruptcy, and Detroit hires emergency financial managers. But governments are fighting back. Apple Inc. (NASDAQ:AAPL) was questioned before a Senate subcommittee to figure out how it lessens its tax burden, which the Senate’s report claimed amounted to $10 billion in tax avoidance per year. While the federal corporate tax rate is set at about 35%, Apple Inc. (NASDAQ:AAPL)’s 2011 annual report showed a federal tax rate of 20%, but its IRS returns recorded a payment that amounted to only a 7% tax rate.