As the Federal Reserve hints at tapering its bond buying program over the next year, cyclical stocks, including technology, should become interesting buys. Tech stocks have underperformed the market rally over the last year as investors have piled into high-yielding stocks to counter low bond yields. Now that money should flood out of those stocks and bonds into growth stocks.

The main reason the Fed would stop bond buying would be a generally stronger economy, a situation that should benefit tech stocks that have underperformed. One group that should outperform in this rotation into growth stocks includes Apple Inc. (NASDAQ:AAPL), Intel Corporation (NASDAQ:INTC), and QUALCOMM, Inc. (NASDAQ:QCOM). These beaten-down stocks not only offer the ability to rebound off weak trading, but the businesses could improve as economies around the world rebound. Not to mention all three stocks offer dividend yields over 2.3%, which should be attractive in the low-yield environment.

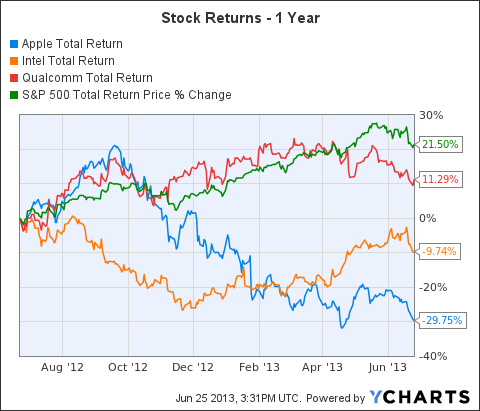

As the chart below shows, these stocks have dramatically underperformed the market over the last year:

AAPL Total Return Price data by YCharts

Leading tablet producer

After losing nearly 30% over the last year, the former largest stock in the world now offers a compelling valuation trading at 9 times next years earnings while yielding 3%. Apple Inc. (NASDAQ:AAPL) continues to produce innovative products, but the lead in the important smartphone and tablet markets has been diminished to the point that some believe Samsung produces better gear. The company still maintains a rabid user base tied into the operating system and iTunes purchases.

With a marker cap around $375 million and cash balance around $150 million, Apple Inc. (NASDAQ:AAPL) has an absolutely compelling valuation, even considering the waning dominance in key markets. Regardless, analysts still see huge earnings and strong cash flow that will allow the company to continue buying back stock on the cheap and raising the dividend rate.

High yielding semiconductor

Intel Corporation (NASDAQ:INTC) offers one of the highest yielding stocks that has underperformed the market over the last year. At last count, the stock offers a 3.7% yield and only trades at 12 times forward earnings. Analysts expect earnings to grow at an 11% rate over the next five years, though the 2014 numbers are below those reported in 2012.

As with Apple Inc. (NASDAQ:AAPL), Intel Corporation (NASDAQ:INTC) has reached a valuation and revenue base suggesting that growth might have maxed out. The company, however, continues to generate huge profits and cash flows that allow it to pass the cash on to shareholders via stock buybacks and large dividends.