Bitcoin will fail because a small number of hoarders control most of the supply

Blockchain.info, which claims to be Bitcoin’s most popular wallet (every user needs a digital “wallet,” which is something like an anonymous checking account, to transact Bitcoins), provides the following statistics on its userbase and on Bitcoin itself. I’ve rounded some numbers for convenience:

Total wallet users: 180,400.

Bitcoins created to date: 11,000,000.

Bitcoin transaction volume (weekly moving average): 344,000.

Wallet users engaging in transactions (weekly moving average): 10,000.

Total Bitcoin exchange dollar volume (weekly moving average): $9,600,000.

Estimated Bitcoins transacted on exchanges (at $135 price): 71,000.

According to these figures, only about 3% of all Bitcoins are in circulation at the moment, and less than 1% of all Bitcoins currently in existence are sold on the exchanges. With less than 10% of wallet users actually engaged in transacting their Bitcoins, it becomes easier to see why even a little bit of news can cause massive price swings.

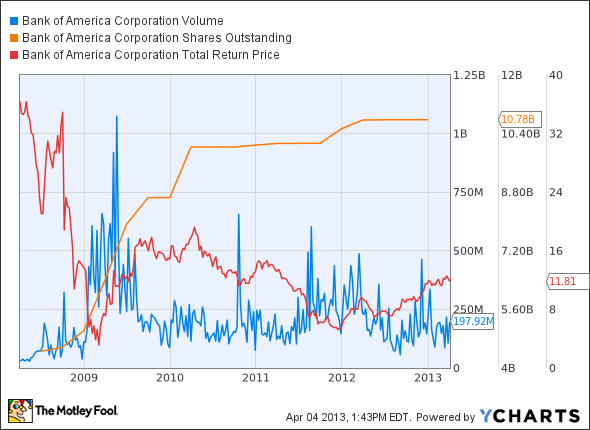

It’s actually a bit instructive to look at this against some highly liquid stocks. Bank of America (NYSE:BAC), for example, is nearly always one of the highest-volume stocks on the market. Here’s what’s happened to its price over time:

BAC Volume data by YCharts.

Bank of America (NYSE:BAC)’s share price does better when fewer of its shares are traded, as is generally the case for most things traded on public markets. Supply and demand is a relatively easy thing to explain. If I had a million shares of Bank of America (NYSE:BAC), I could sell them and live comfortably for the rest of my days, but my sale would barely move the price of a stock that experiences at least 200 times that much trading volume on any given day.

On the other hand, if I sell a million Bitcoins, the price will crash through the floor, because there simply aren’t that many people actually looking to buy any Bitcoins. The average transaction, according to recent data, was only about seven Bitcoins per wallet for only 10,000 unique wallets, and yet the price has absolutely skyrocketed. Very few people want to sell their Bitcoins, even though the user base is already fairly tiny. If even 1,000 panicked Spaniards flood into Bitcoin (this has been suggested as a primary reason for the recent spike) out of fear that their bank accounts will be confiscated, they’ll find even higher prices until anyone with substantial holdings decides to sell. And why should they sell?

The counterargument here goes something like this: More publicity will bring more people into Bitcoin, and the ecosystem will grow! This will make Bitcoin more stable, and people will be more willing to sell or transact fractions rather than whole Bitcoins, which will increase price stability as people adapt to transacting smaller quantities of a more valuable digital currency.

But here’s the thing: So long as the current holders of most Bitcoins have a greater expectation of price growth in the future, they will never put more Bitcoins on the open market than will be demanded by new users. Divisibility doesn’t matter so much as availability. You can divide a Bitcoin into a million little Bitcoin pieces and sell each piece for a fraction of a penny, but in the end you’re still only transacting $135 worth of a billion-dollar bubble. Bitcoin, by design, actually bakes in an expectation of higher prices in the future, as the Bitcoin wiki points out:

Bitcoin users are faced with a danger that doesn’t threaten users of any other currency: If a Bitcoin user loses his wallet, his money is gone forever, unless he finds it again. And not just to him; it’s gone completely out of circulation, rendered utterly inaccessible to anyone. As people will lose their wallets, the total number of Bitcoins will slowly decrease.

Therefore, Bitcoin seems to be faced with a unique problem. Whereas most currencies inflate over time, Bitcoin will mostly likely do just the opposite. Time will see the irretrievable loss of an ever-increasing number of Bitcoins. An already small number will be permanently whittled down further and further. And as there become fewer and fewer Bitcoins, the laws of supply and demand suggest that their value will probably continually rise.

Thus Bitcoin is bound to once again stray into mysterious territory, because no one exactly knows what happens to a currency that grows continually more valuable. Many economists claim that a low level of inflation is a good thing for a currency, but nobody is quite sure about what might happens to one that continually deflates. Although deflation could hardly be called a rare phenomenon, steady, constant deflation is unheard of.

A Bitcoin is an investment in the continued interest of a tiny group of people, many of whom are ironically afraid of the perceived instability of widely accepted fiat currencies. Wide acceptance of Bitcoin — and thus greater stability — would require a user base several orders of magnitude larger than the one we currently see in Blockchain’s numbers. That could happen in the future, but the hoarding of existing users acts as a barrier against wider adoption. Why would any casually interested person want to get involved with Bitcoins beyond an attempt to hoard it if the supply will always be constricted? On the other hand, a sudden influx of Bitcoins onto the exchanges, and the resulting price crash, would also undermine wider adoption, as it would break the illusion of steadily rising value that has brought more users in the first place.

There are other reasons why I feel Bitcoin is doomed to fail, and I’ll be examining those reasons over the next few days. Stay tuned for:

Why an uncertain legal standing will never resolve in Bitcoin’s favor.

Why Bitcoin’s perceived “security” and lack of transparency are not true benefits.

Why cryptocurrencies can’t succeed by rejecting the characteristics of modern (centralized) money.

Got questions? Want to weigh in? Feel free to let me know how you feel with a comment below.

The article Why Bitcoin Is Doomed to Fail originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more insight into markets, history, and technology.The Motley Fool recommends Apple. The Motley Fool owns shares of Apple and Bank of America.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.