Apple Inc (NASDAQ:AAPL) is the most popular stock among hedge funds and billionaires, and it is performing spectacularly. Despite Apple Inc (NASDAQ:AAPL)’s successful performance hedge funds are underperforming the market third year in a row. The reason is simple. Equity hedge funds usually hedge around 50% of their long exposure. It just doesn’t make sense to compare them to the S&P 500 index which is 100% long. So we came up with a better way of illustrating hedge funds’ true stock picking ability and constructed an index that is 100% long. We launched the Insider Monkey Billionaire Hedge Fund Index at the beginning of this year. The index is based on the 13F disclosures of billionaire hedge fund managers and prominent investors. It is composed of the 30 most popular stocks among billionaires and each stock’s weight is proportional to its popularity. We update the index around 50 days after the end of each quarter to give ourselves enough time to process the filings. I can hear you questioning whether there is any value in imitating hedge funds’ stock picks two months after they are known to be holding these stocks. Some may argue that they may have sold or even started to short these stocks during this two month delay. Technically it is possible but we don’t think it is probable.

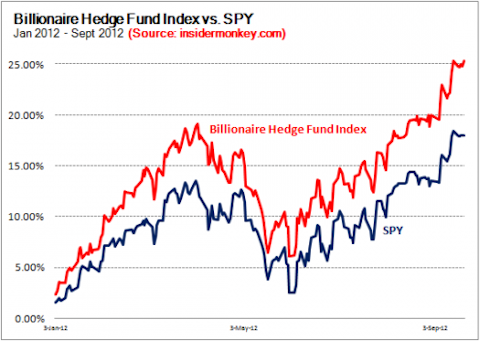

Since the beginning of this year Insider Monkey’s Billionaire Hedge Fund Index returned 25.3% vs. a gain of 18% for the S&P 500 (INDEXSP:.INX) including dividends. Of course an average equity hedge fund didn’t return 25.3% so far this year because hedge funds aren’t usually 100% long and they charge hefty fees. Our index avoided these shortcomings and managed to beat the market by 7 percentage points despite using “stale” data. Let’s take a look at the top 5 stocks in this index at this moment:

1. Apple is the most popular stock among billionaire fund managers. More than 40% of the billionaires had a large position in Apple at the end of June. Apple is also the most popular stock among other hedge fund managers (see the 10 most popular stocks). Apple has been an obvious value play for a very long time. At the beginning of 2011 the market valued the stock as if it was a low growth utility stock. By the end of the summer of 2011, low growth utility stocks had even higher multiples than technology stocks like Apple Inc and Microsoft Corporation (NASDAQ:MSFT). Investing in Apple was really a no brainer. It is still very attractively priced despite returning 73.6% so far this year. Billionaires Ken Griffin, David Einhorn, and Stephen Mandel are extremely bullish about the stock.

2. Google Inc (NASDAQ:GOOG) is the second most popular stock among billionaire hedge fund managers. The stock gained 13.6% so far this year. We are optimistic about Google as well. The stock’s 2013 forward PE ratio is less than 15. It is slightly more expensive than Apple but the stock is the undisputed leader of the search business. It is expected to increase its earnings by nearly 20% per year over the next few years. We expect that Google will outperform the market over the next five years. Chase Coleman and Ken Fisher have large positions in Google.

3. Qualcomm Inc (NASDAQ:QCOM) is the third most popular stock among billionaire hedge fund managers. The stock returned 18.9% since the beginning of this year. Qualcomm is also a fast growing stock with relatively low earnings multiples. Qualcomm increased its revenues by 28% and its EPS by 19% in the most recent quarter compared to the same quarter in 2011. The company has a trailing PE ratio of 19. David Tepper and Leon Cooperman are bullish about the stock.

4. Microsoft is the fourth popular stock among billionaire hedge fund managers. It should be clear to you by now that billionaires have been very bullish about tech stocks and they still are. Apple and Microsoft have been among the 5 most popular stocks for at least two years. The stock returned 22.6% since the end of 2011. Jim Simons, Ray Dalio and David Einhorn have been adding to their Microsoft holdings during the second quarter (see Ray Dalio’s stock picks).

5. News Corp (NASDAQ:NWSA) is the fifth most popular stock among billionaires. When several investors were selling News Corp at below $15 in the summer of 2011 after the scandal, billionaires started buying the stock. There are several positive developments for the stock this year. It is an election year and both candidates are fund raising machines. News Corp also announced that it will be splitting the company which is usually enough reason for hedge funds to initiate positions. This stock outperformed the market with a 41% return so far this year. Billionaires Dan Loeb, Paul Singer, and Stephen Mandel initiated brand new positions in the stock during the second quarter (check out Dan Loeb’s new picks).

Hedge funds’ top 5 stock picks performed even better than the rest of their stock picks. These five stocks had an average return of 33.9%, beating the market by more than 15 percentage points. Our billionaire hedge fund managers became billionaires because of their stock picking ability. Their recent performance shows that they still have their magic touch.

Disclosure: Meena has long positions in Apple, Google, and Microsoft.