Julian Robertson’s Tiger Management and Rob Citrone’s Discovery Capital Management, the latter of which is a Tiger Club hedge fund seeded by the former, have shown a lot of similarities in their investment approaches. Robertson is a legend when it comes to hedge fund management, having beaten the S&P 500’s average return of 12.7% by 19% between 1980 and 1998. That stellar performance has made him a voice to be reckoned with on matters of hedge fund management and stock performance. Rob Citrone on the other hand founded Discovery Capital in 1999 and has been delivering 17% in returns since. Both funds submitted their 13F filings to the U.S. Securities and Exchange Commission for the reporting period of March 31. According to the filings, Tiger Management had $596.87 million worth of stocks in its public equity portfolio value while Citrone’s Discovery Capital had $8.78 billion in its own public equity portfolio value, while also managing $37.50 billion in assets under management. Both funds had notable stakes in the technology and services industry. In this article, we want to look at three stocks in the former sector that the duo is all over, having each invested heavily in Alibaba Group Holding Ltd (NYSE:BABA), Apple Inc. (NASDAQ:AAPL), and Facebook Inc (NASDAQ:FB).

At Insider Monkey, we track hedge funds’ moves in order to identify actionable patterns and profit from them. Our research has shown that hedge funds’ large-cap stock picks historically delivered a monthly alpha of six basis points, though these stocks underperformed the S&P 500 Total Return Index by an average of seven basis points per month between 1999 and 2012. On the other hand, the 15 most popular small-cap stocks among hedge funds outperformed the S&P 500 Index by an average of 95 basis points per month (read the details here). Since the official launch of our small-cap strategy in August 2012, it has performed just as predicted, returning over 142% and beating the market by more than 83 percentage points. We believe the data is clear: investors will be better off by focusing on small-cap stocks utilizing hedge fund expertise rather than large-cap stocks.

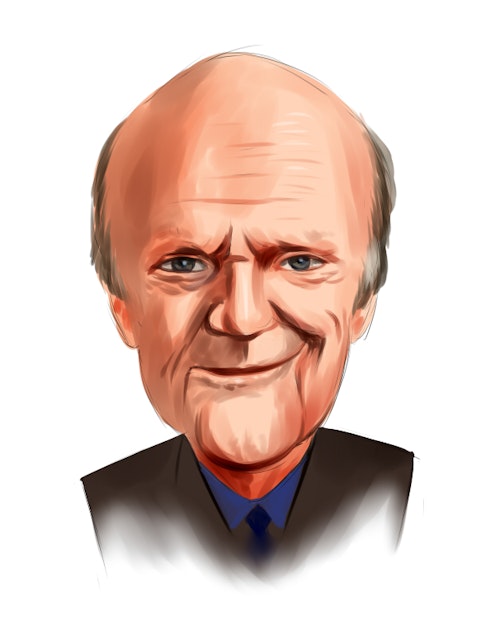

Follow Julian Robertson's Tiger Management

Let’s first consider Alibaba Group Holding Ltd (NYSE:BABA), in which Robertson held 636,878 shares valued at $53.01 million at the end of the first quarter, having raised his stake from 571,183 shares at the end of the fourth quarter of 2014. This stock meanwhile, was Citrone’s largest holding at the end of the first quarter, as he held 8.77 million shares with a market value of $730.36 million, though that position was down from the 9.25 million shares he held as of the previous reporting period. The greater than $200 billion market cap Chinese company has had a lot going on since it held its record $25 billion initial public offering in the U.S late last year. Alibaba Group Holding Ltd (NYSE:BABA) recently announced a partnership with TDI International, a leading Indian advertising company, for the provision of an active advertisement platform through which the e-commerce giant can reach out to small and medium enterprises. This comes on the heels of another deal with MYPACCO, an Indian logistics company, aimed at providing small and medium enterprises with financing, logistics, and other financial services, with the services being offered through Alibaba.com.

Reports have it that the online retailer is focused on making serious inroads in the U.S. market and will soon invest heavily in Hollywood’s movie-making business. Some other investments that are underway include the launch of an affiliates’ online-only bank, China’s Netflix version called Tmall Box Office, and a Taxi App. While a number of analysts have lowered their price targets on the stock, its rating still remains a “Buy” after securing 45 “Buy” ratings from 51 analysts that cover the stock. Alibaba Group Holding Ltd (NYSE:BABA) has been given a 12-month average target price of $108.40, representing 36.7% potential upside based on the stock’s $86.62 price in afternoon trading Thursday. The company reported earnings per share of $0.48 for the first quarter of 2015, easily beating analysts’ consensus estimate of $0.28. At the end of the first quarter, a total of 86 hedge funds that we track had stakes in the stock. Out of the 86, 14 of them were run by billionaire. Some of these funds were billionaire Andreas Halvorsen‘s Viking Global and Alec Litowitz and Ross Laser’s Magnetar Capital.