Acuity Brands’ secular growth drivers

The decreasing cost (per lumen) of LEDs means that Acuity can generate growth from LED lighting replacing conventional lighting. Margins on LED lighting are similar to conventional bulbs, but Acuity argues that it sells controls with virtually all its LED lights. Lighting controls are an essential part of the value proposition because, they help to increase the efficiency of lighting solutions.

The good news is that this is driving sales growth. Its net sales were up 11% in the third quarter, as opposed to the ‘low single digit growth rates’ that it claims its markets are growing at. The ‘bad’ news is that volumes grew by 14%. The discrepancy is due to lower prices of LED components and an unfavorable product mix. Essentially, Acuity Brands, Inc. (NYSE:AYI) is providing relatively more solutions to lower margin renovation work because large scale new construction hasn’t kicked in yet thanks to the slow economy.

Acuity’s LED-based revenue is now at 20% of its total, from 15% and 13% in the previous two quarters. This is a powerful trend.

For example, a company like Cree, Inc. (NASDAQ:CREE) is more of a pure LED play than Acuity. It offers a vertically integrated way to play growth in LEDs. Lighting looks set to be the primary driver of the next upswing in the LED cycle. Cree’s own lighting division managed to increase sales by 6% in the last quarter, even with unseasonal weather negatively affecting outdoor lighting sales.

Cree’s lighting products gross margins are at 30.6%, while Acuity Brands, Inc. (NYSE:AYI)’s numbers are at a more impressive 40.8%. Acuity has a more mature sales operation, while Cree uses sales agents. Nevertheless, Cree appears to have the opportunity to improve its lighting products margins going forward. Cree’s lighting product revenues currently represent nearly 38% of its total, so the opportunity is significant.

Cyclical growth drivers

Acuity can see cyclical growth in two ways. The first is from a general pickup in construction activity, and the second is through margin expansion, as more profitable activity like large-scale new construction takes place. Historically speaking, the former usually entails the latter.

In addition, investors need to appreciate that lighting is one of last phases of construction, so a natural time lag exists between general activity and orders coming in for lighting.

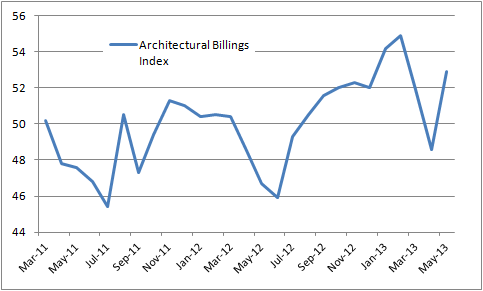

All eyes will be fixed on construction indicators such as the Architectural Billings Index (ABI) from the American Institute of Architects. It has been unusually volatile lately.