One of the leaders in jewelry and high-end gift items, Tiffany & Co. (NYSE:TIF). is synonymous with “luxury” all over the world. When the financial crisis hit in 2008-09, and retailer of items that were seen as non-essential or luxuries took an enormous hit in the market, and Tiffany was no exception, sinking to a 2008 low of just $16.75 after trading above $55 just the year before.

As mentioned, Tiffany & Co. (NYSE:TIF) is a truly international company and is getting bigger. In 2012, 50% of the company’s revenue came from North America, with 21% from Asia (excluding Japan), 17% from Japan, and 12% from Europe, where I see the most potential for expansion once Europe’s economic troubles are behind them.

In fact, the company recently opened their first store in Eastern Europe (Prague), and they have expressed interest in other emerging markets such as Russia and India.

So, why should investors buy stock in Tiffany & Co. (NYSE:TIF) as opposed to competitors such as Signet Jewelers Ltd. (NYSE:SIG) or even an online giant such as Amazon.com, Inc. (NASDAQ:AMZN) which does not have the overhead that physical retailers do and can undercut virtually any other retailer.

Signet Jewelers is not a very well-known name, but the stores they operate are. Signet operates over 1,300 stores in the U.S., mostly under the names Kay Jewelers and Jared the Galleria of Jewelry. Jared is very well-known due to their many advertisements with the catchy line “he went to Jared.” Signet trades at a much cheaper valuation than Tiffany at just 15 times earnings, with pretty similar growth projected.

Amazon can certainly undercut most retailers’ prices and they do have a nice selection of fine jewelry (I actually bought my wife’s engagement ring on Amazon). However, this is one area where internet-based businesses do not have the usual advantage. With a major purchase such as jewelry, consumers like being able to physically see, touch, and inspect what they purchase, and are willing to drive to a store to do so.

While I won’t recommend Amazon as an investment until its stock plunges by at least 50%, they are indeed a threat to monitor. Amazon is actively trying to become a major player in the fashion world, moved up this year to the United States’ 20th largest jeweler by sales to the 16th (Tiffany is a close number three to leaders Sterling Jewelers and Wal-Mart). While their annual sales of around $300 million in jewelry pale in comparison to Tiffany & Co. (NYSE:TIF) for the time being, their jewelry sales did increase by 17% just last year, and that growth can’t be ignored.

The main thing that Tiffany & Co. has that the others don’t is one of the most respected and recognized brand names in jewelry. Few things can get a man out of the doghouse faster than the sight of a Tiffany & Co. gift box!

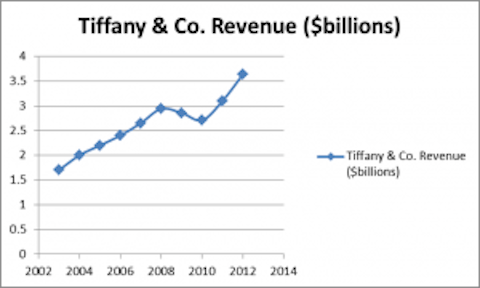

For this recognition and growth potential, the brand commands a premium. Tiffany & Co. currently trades for just over 20 times fiscal year 2013’s (which ended January 31) earnings of $3.21 per share. While the consensus projects a forward growth rate of approximately 12% annually, I don’t feel quite confident enough in the company’s ability to grow as much as expected over the next few years.

After Europe gets its act together economically, since this is where Tiffany & Co. (NYSE:TIF) has the most near-term growth potential, I would be more willing to pay a premium. For now, although I like the company and believe in it long-term, I would wait for a better entry point before making a move.

The article A Great Brand, Just A Bit Too Expensive originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.