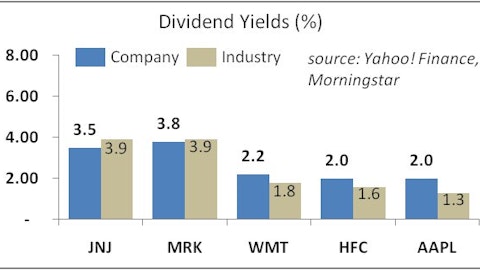

Three new dividend increases for Druckenmiller’s portfolio were in the pharma space. The manager’s stake in each pharma company was increased by at least 40% during 3Q. Merck & Co., Inc. (NYSE:MRK), after a 43% share increase from 2Q, is now Druckenmiller’s fifth largest 13F holding. Merck is expected to see year-end sales decline due to the patent expiration on its respiratory drug Singulair, and pays a dividend yield of nearly 3.8%.

Although the company has a pipeline of other drugs, we see little value when comparing it to top competitor Pfizer Inc (NYSE:PFE). Merck and Pfizer trade in lockstep on a valuation basis and in terms of dividend yield, but Merck has a debt to equity ratio of 1.5, triple that of Pfizer. With Merck only expected to grow five-year earnings at 5% annually, we believe investors can find better values in pharma. Merck is also a Kahn Brothers’ Top Pick for 3Q.

Pfizer is in the process of selling its nutrition business to Nestle, which should help boost cash to buy back shares and continue to pay its 3.6% dividend yield. The other cash-generating event will be the IPO of 20% of its animal health business.

Eli Lilly & Co. (NYSE:LLY), a 48% increase in 2Q shares owned by Druckenmiller, pays the highest dividend of our three pharma stocks at 4.1%. Eli Lilly is currently trying to execute a fairly new strategy to combat the loss of patent protection on various drugs. Helping counter this loss will be Eli’s entry into Japan and other emerging markets. Eli also has 13 of its 66 drugs in pipeline that are currently under regulatory review and in Phase III trials. The company’s shares also have the lowest valuation of the three pharma stocks mentioned here at 13x earnings, making for quite a value play.

Furthermore, two of Druckenmiller’s remaining top five picks were new additions from the oil and gas industry that also pay top-notch dividends. Exxon Mobil Corporation (NYSE:XOM) was Druckenmiller’s number one stock that made up 6.7% of his firm’s 3Q 13F. Chevron Corporation (NYSE:CVX), also a new pick for Druckenmiller in 3Q, takes the fourth spot in his 13F.

Exxon and Chevron – two giants in the oil and gas industry – trade in line at 9x earnings and both pay solid dividends. The dividend yield on Exxon shares is 2.6%, while Chevron’s yield is 3.4%. As global GDP is expected to grow 2.3% in 2012 and 2.6% in 2013, it should boost demand for both oil and gas.

Exxon plans to target production growth of 1%-2% a year through 2016 with strong downstream operations – namely U.S. refining – and upstream growth opportunities, including increasing its focus on deepwater. Production for Chevron is expected to be 4%-5% from 2014 to 2017 on the back of downstream operations restructuring. Chevron expects to continue acquisitions with a focus on exploring and producing properties. Around 90% of 2012 CapEx is expected to be spent on E&P operations, spread geographically across Asia, the Americas and Africa.

Druckenmiller’s two big oil and gas bets should yield positive results in the long term given their industry-leading positions and strong global growth outlook. Additionally, we prefer Pfizer and Eli Lilly to Merck. The pharma companies mentioned are more advantageous to income investors, compared to the oil and gas companies; each offers a yield of at least 3.6%. Exxon pays the lowest dividend yield of the five stocks, while Chevron pays 3.4%. Check out all of billionaire Stanley Druckenmiller’s 3Q stocks picks.