Yum! Brands, Inc. (NYSE:YUM), Fidelity National Financial Inc (NYSE:FNF), Platform Specialty Products Corp (NYSE:PAH), and B/E Aerospace Inc (NASDAQ:BEAV) are among the top picks of the well-known activist investor Keith Meister‘s Corvex Capital. Since following activists into some of their top picks can be a good strategy to beat the market, let’s take a closer look at Corvex’s investments in these companies and assess the general hedge fund sentiment towards them.

Before we get to the companies, in question, let’s take a closer look at the fund. Corvex Capital was founded in 2011 by Keith Meister, the former right hand of billionaire activist Carl Icahn. At the end of June, the fund had an equity portfolio worth $7.44 billion. Some 65% of the portfolio was equally invested in Consumer Discretionary and Financial sectors. According to our analysis of Corvex’s equity portfolio, out of 24 long positions, 22 were represented by companies worth at least $1.0 billion and these holdings posted a weighted average return of 11.12% during the third quarter, based on the size of these positions at the end of June.

Yum! Brands, Inc. (NYSE:YUM), which was Corvex’s top pick at the end of June, was also one of the fund’s most profitable investments, as the stock gained 10.1% during the third quarter. The fund entered the period with an $1.74 billion stake containing 21.04 million shares. Overall, 46 funds tracked by us held shares of Yum! Brands, Inc. (NYSE:YUM) at the end of June, down by five funds over the quarter. Corvex was the top shareholder, followed by Lone Pine Capital with a $826.9 million position. Other investors bullish on the company included Soroban Capital Partners, Third Point, and AQR Capital Management.

Follow Yum Brands Inc (NYSE:YUM)

Follow Yum Brands Inc (NYSE:YUM)

Receive real-time insider trading and news alerts

Then there’s is Fidelity National Financial Inc (NYSE:FNF), in which Corvex held 18.82 million shares worth $705.64 million at the end of June. In the following three months, the stock inched down by 1%. During the second quarter, the number of funds from our database long Fidelity National Financial Inc (NYSE:FNF) declined by 11% to 39. Here too, Corvex held the largest stake and trailing it was Orbis Investment Management, which amassed a stake valued at $150.2 million. OZ Management, Roystone Capital Partners, and Bloom Tree Partners also held valuable positions in the company.

Follow Fidelity National Financial Inc (Old Filings) (NYSE:FNF)

Follow Fidelity National Financial Inc (Old Filings) (NYSE:FNF)

Receive real-time insider trading and news alerts

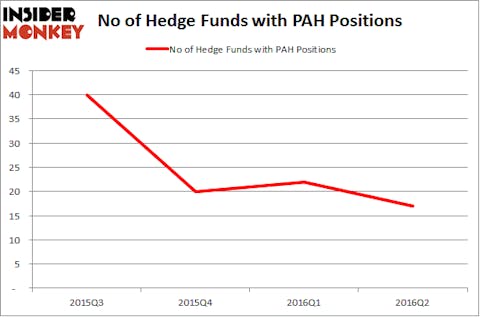

Even worse was the performance of Platform Specialty Products Corp (NYSE:PAH), which lost 8.7% between July and September and is 33% in the red year-to-date. Meanwhile, Corvex held 14.43 million shares of the company worth $128.15 million heading into the third quarter. In addition, the stock saw a decline in popularity among the funds in our database, with the number of those bullish on Platform Specialty Products Corp (NYSE:PAH) falling to 17 from 22 during the second quarter. However, aside from Corvex, the company has another great activist among its top shareholders – Bill Ackman’s Pershing Square, which held $379.5 million worth of shares at the end of June. Remaining hedge funds and institutional investors with similar optimism consist of Brian Bares’s Bares Capital Management, John Griffin’s Blue Ridge Capital and Murray Stahl’s Horizon Asset Management.

Follow Element Solutions Inc (NYSE:ESI)

Follow Element Solutions Inc (NYSE:ESI)

Receive real-time insider trading and news alerts

On the other hand, B/E Aerospace Inc (NASDAQ:BEAV), in which Corvex had initiated a stake during the second quarter, saw its shares gain 12.4% in the following three months. The fund amassed 2.70 million shares worth $124.82 million, being one of 33 funds that held shares at the end of June, versus 36 funds a quarter earlier. The largest stake in B/E Aerospace Inc (NASDAQ:BEAV) was held by Highfields Capital Management, which reported holding $219.7 million worth of stock at the end of June. Other investors bullish on the company included Blue Mountain Capital, Roystone Capital Partners, and Farallon Capital.

Follow B/E Aerospace Inc (NASDAQ:BEAV)

Follow B/E Aerospace Inc (NASDAQ:BEAV)

Receive real-time insider trading and news alerts

Disclosure: none