Positioning ourselves in the stock market can be really difficult, but by getting an inside look on what CEOs are thinking we can better prepare ourselves going forward.

CEOs in the United States believe in organic growth and acquisitions

Source: PricewaterhouseCoopers

Going forward, 41% of CEOs believe that the economy will be the primary driver in growth, which is up by 3% year-over-year. CEOs in the United States are relying less on product development (risky), and instead focusing more on acquisitions and joint ventures/strategic alliances. Going forward, we can anticipate that 62% of the growth is dependent on the economy, and buyouts.

The rush to acquire companies

Real world examples of acquisitions include salesforce.com, inc. (NYSE:CRM) and its buyout of ExactTarget Inc (NYSE:ET). Silicon Valley is also busy buying out companies. Examples of this include Yahoo! Inc. (NASDAQ:YHOO) and its recent acquisition of Tumblr, and Google Inc (NASDAQ:GOOG)’s recent buy out of Waze. In telecom, we have a flurry of deal making, with Verizon Communications Inc. (NYSE:VZ) rumored to buy out Vodafone Group Plc (ADR) (NASDAQ:VOD)’s stake in Verizon. DISH Network Corp. (NASDAQ:DISH) is eying a take-over attempt of Clearwire Corporation (NASDAQ:CLWR). SoftBank is fighting to close the Sprint deal by the end of the month.

The energy sector is full of deals with Exxon Mobil Corporation (NYSE:XOM) buying out Celtic Exploration. Chevron Corporation (NYSE:CVX) is expected to buyout Royale Energy. There are also rumors of Royal Dutch Shell plc (ADR) (NYSE:RDS.A) buying out BP plc (ADR) (NYSE:BP), and in industrials we have General Electric Company (NYSE:GE) planning to spin-off its GE Capital.

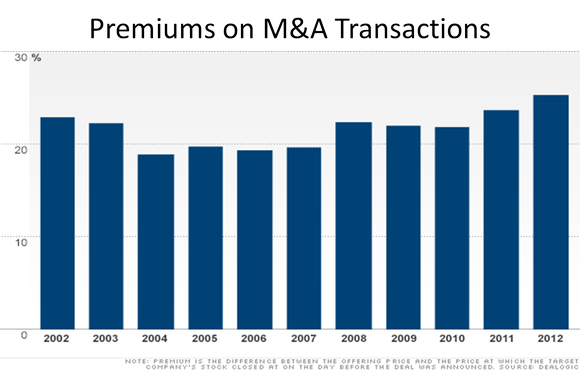

Source: Fortune

Currently and based on 2012 statistics, companies are willing to pay a 25% premium over a stock’s current trading price. A stock portfolio could be an overnight success just by owning the right stock. However, the sectors with the highest likelihood of a buyout would include information technology, web properties, telecoms, energy, and biotechnology.

Technology investors have a built-in premium on the value of their investment because buyouts are common in the technology sector.

What to buy

I prefer to focus on bigger companies, as there is a whole heck of a lot less volatility in this approach. Large companies employ an acquisition strategy because it lowers the cash balance on a balance sheet, and results in a direct increase in revenue and net-income. This helps to improve the earnings per share, and cash from operations on a company’s cash flow and income statement. Companies in the technology sector are taking on a twofold approach for cutting costs, and buying companies while experiencing the benefits of a growing economy.

Since I don’t know what companies will or will not be bought out, I will focus on the companies that are doing all the buying.

Let’s start with Yahoo!

Yahoo! Inc. (NASDAQ:YHOO) is a compelling investment opportunity going forward. Magna Global forecasts that global ad spending will grow by 6.9% in 2014 versus 3.9% growth in 2013. Based on this forecast we can assume that Yahoo! could have some upside surprises in its core businesses in 2014. The company has reduced spending on research and development, sales, general, and administrative costs by around 27% over the past five-years. The company then redirected all of that cash toward buyouts. The company has a successful track record of identifying potential opportunities in the tech space.

Analysts on a consensus basis anticipate this company to grow earnings by 20% for the 2013 fiscal year. The stock trades at a 7.7 earnings multiple, but this record low multiple is driven by its recent earnings recognition from selling half of its stake in Alibaba. That being the case, the company trades at a very reasonable 7.1 price-to-cash-flow ratio. The stock is a great value investment.

International Business Machines Corp. (NYSE:IBM)is another compelling investment opportunity that investors shouldn’t ignore. The company has an impressive portfolio of products and services. However, going forward the company believes that it can grow its earnings to $20 per share from its’ current $14.50 per share.

The company has a 2015 road map of generating half of its revenue from software, organic growth from emerging economies, $8 billion in cost cutting, $70 billion in share buybacks, and $20 billion in acquisitions.

The company’s acquisition strategy, which is similar to Yahoo’s!, is also likely to bear fruit for shareholders. The combined factors should keep investors aboard International Business Machines Corp. (NYSE:IBM).

Hewlett-Packard Company (NYSE:HPQ) could be a significant growth vehicle. The company’s growth in net income will be driven by process improvements along with cost-cutting efforts. The company will most likely adopt a strategy of acquiring strategic businesses.

Future strategic acquisitions will have to generate net income otherwise I couldn’t imagine how CEO Meg Whitman could convince the board of more buyouts. Especially when considering the $18 billion impairment cost (depreciation of intellectual property) the company experienced in 2012.

Whitman believes that the company will resume revenue growth from 2014 onward. The company’s combined efforts of cost cutting paired with stabilizing computer demand due to the loss of XP support from Microsoft Corporation (NASDAQ:MSFT) in 2014 will support the company’s growth.

Conclusion

Investors should anticipate large companies to supplement growth through acquisitions. Right now, smaller companies in the tech sector are likely to be bought out, so make note of this when buying smaller technology stocks. I also believe that International Business Machines Corp. (NYSE:IBM), Hewlett-Packard Company (NYSE:HPQ), and Yahoo! Inc. (NASDAQ:YHOO) will be lucrative investment opportunities going forward.

Alexander Cho has no position in any stocks mentioned. The Motley Fool owns shares of International Business Machines..

The article Why There Is a Gold Mine in Acquisitions originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.