Despite the attention the media puts on new management, the fundamentals of Yahoo! Inc. (NASDAQ:YHOO) have not changed that much recently. Furthermore, the fact that the stock price continues outperforming NASDAQ shows that investors’ expectations are much higher than the value fundamentals dictate. But, high expectations cannot last forever. If Yahoo! Inc. (NASDAQ:YHOO) does not improve its fundamentals, the stock price will eventually start falling.

Yahoo! Inc. (NASDAQ:YHOO) needs revenue growth as soon as possible. But, is acquiring companies like Tumblr the solution?

When you buy a certain stock not because of its underlying organic value, but because of the ROI from some acquisitions it has made in the past, you are actually buying an IT fund. This is what Yahoo! Inc. (NASDAQ:YHOO) looks like. So, if we were to look at Yahoo! as a portfolio of investments, what is the acquisition of Tumblr adding to the portfolio?

The deal

Yahoo! Inc. (NASDAQ:YHOO)’s board approved a massive $1.1 billion all-cash deal to buy Tumblr. Notice that the size and “appetite for artificial growth” in this deal reminds us of the $1 billion Instagram acquisition by Facebook Inc (NASDAQ:FB), or the more successful $1.65 billion YouTube acquisition by Google Inc (NASDAQ:GOOG).

What is Yahoo! getting? Tumblr, founded in 2007, has 175 employees and more than 108 million blogs in its network. According to comScore, it had nearly 117 million unique users world-wide in March, up from about 58 million a year ago.

I tried to find some patents Tumblr possesses and could not find any significant information on the Internet. Therefore, as far as I know, Yahoo! is getting massive traffic: a big microblogging network, top 15 in the U.S., but with very weak monetization figures. They only made $13 million in revenue last year.

Now, what is the cost of this acquisition for Yahoo!? Yahoo! is paying a $300 million additional premium if we consider that the last time Tumblr raised money, in September 2011, the $85 million venture capital investment it received valued the company at $800M.

The upside is that Yahoo! is in a strong financial position at the moment. According to Yahoo! Finance, as of December 2012, the company had about $5.65 billion in total current assets (which include cash and cash equivalents, short-term investments, net receivables, and other current assets). The $1.1 billion investment will decrease the amount of total current assets by 19.6%, a considerable decrease in cash and other equivalents but it does not leave the company financially weak.

Tumblr’s real value

Tumblr has about 117 million unique users world-wide. This sounds like an enormous opportunity for profit, but massive amounts of traffic require high maintenance costs. Because there is no information available on the cost structure, it is hard to make any estimates, but it is a well-known fact that with the current revenue size, advertisement and freemium monetization approach, the firm is not profitable.

Some would say that the $13 million in revenue made last year was before Tumblr became more aggressive about advertisement. They expect to make $100 million in revenue this year, after all. It is too early to be sure about this, but keep in mind that Tumblr has one of the most expensive CPM in the industry and this could keep away many potential advertisers.

Furthermore, even if Tumblr manages to generate consistent revenue in the future, in order for Yahoo! to recover its $1.1 billion premium, they would need to make $1.1 billion in profits. Also, they spent $25 million in 2012 in operating expenses. But now, they have twice the traffic, so let us assume that operating expenses have increased by $15 million (I’m not saying they double because of economies of scale). You have $40 million in operating expenses.

Assuming no growth and excluding taxes and other complex details, if Tumblr were to make $100 million in revenue per year, it would take, roughly speaking, more than 18 years for Yahoo! to recover its premium. That does not sound like a good investment.

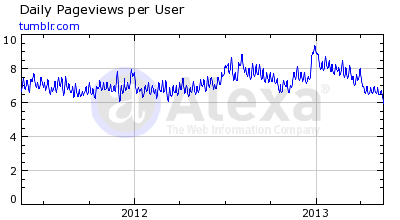

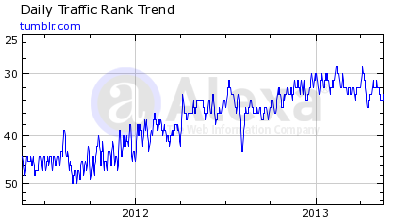

The best possible outcome is a Tumblr IPO. But that is not going to happen. You know that there is something wrong with the prospects of your venture when you decide to put it on sale. And in the case of Tumblr, I think that there are some growth concerns. I know that they almost doubled their user database size in one year, but Alexa shows that the daily pageviews per user have decreased since this year started, which shows less user engagement. Furthermore, it shows that the daily traffic rank stopped increasing in 2013. Maybe, Tumblr is already “big enough.”

In this way, Tumblr’s monetization remains challenging, and there are some concerns about their user database growth in the future. This makes the $1.1 billion deal quite expensive.

Yahoo!’s main competitors

Google Inc (NASDAQ:GOOG) : The main competitor. This is because Yahoo! is still highly dependent on its search engine for revenue: about one third of its net revenue comes from the search engine segment, a place where Google Inc (NASDAQ:GOOG) is the king. Google has an excellent search algorithm and massive traffic. According to ComScore Search Watch (April, 2013), last year, Google’s search engine was responsible for 66.5% of all U.S. search traffic. How about Yahoo!? In February 2012, 13.8%. In April 2013, only 12%.

Notice that unlike Yahoo!, Google Inc (NASDAQ:GOOG) also has its own payments ecosystem: we are talking about the Google Play! store, where Android users can download apps. 30% of the app price goes to Google Inc (NASDAQ:GOOG), which also receives fixed payments for registration from every Android developer. In this way, Google has at least two solid cash cows: the search engine business and the Android business. This allows Google Inc (NASDAQ:GOOG) to be able to invest in new projects as much as it wants: Google+ (the Google social network), Motorola, and many early stars in the valley.

Facebook Inc (NASDAQ:FB) : Facebook is finding monetization challenging but unlike Yahoo!, it owns a unique asset: a 1 billion people social network. And because many of its users are very engaged due to the unique social mechanics Facebook Inc (NASDAQ:FB) provides, I think their traffic is safe. Facebook Inc (NASDAQ:FB) now occupies the second position in the Alexa U.S. Rank, while Yahoo! is in the fourth.

Notice also that when Facebook Inc (NASDAQ:FB) finds a better monetization approach, upward momentum will improve. Yahoo!, on the other hand, is already excellent at monetization, but does not have any “unique asset.” This is why they are so active in acquisitions.

Summary

Yahoo!’s share price has increased more than 80% in the past 12 months. However, revenue basically remains flat. To keep up with high expectations, Yahoo! needs to get artificial growth from acquisitions. However, the recent acquisition of Tumblr may not add significant revenue. Finally, we should remember that Google and Facebook are hard to beat competitors because their products are very unique. Yahoo! owns many services but nothing “very unique” so far. Acquiring early stars can help to partially solve this issue.

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Facebook and Google. The Motley Fool owns shares of Facebook and Google.

The article Tumblr’s Acquisition Is an Expensive Deal originally appeared on Fool.com and is written by Adrian Campos.

Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.