Alger Capital, an investment management company, released its “Alger Weatherbie Specialized Growth Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. During the quarter, Class A shares of the fund underperformed the Russell 2500 Growth Index. The fund returned 3.01% (without sales charges) compared to 4.72% for the benchmark. The Energy and Industrials sectors contributed to the fund’s relative performance in the quarter, while Information Technology and Health Care sectors detracted from performance. In addition, you can check the top 5 holdings of the fund to know its best picks in 2022.

Alger Weatherbie Specialized Growth Fund highlighted stocks like Xometry, Inc. (NASDAQ:XMTR) in the Q4 2022 investor letter. Headquartered in Derwood, Maryland, Xometry, Inc. (NASDAQ:XMTR) is a marketplace that provides buyers to source manufactured parts and assemblies. On February 24, 2023, Xometry, Inc. (NASDAQ:XMTR) stock closed at $31.15 per share. One-month return of Xometry, Inc. (NASDAQ:XMTR) was -4.62%, and its shares lost 36.31% of their value over the last 52 weeks. Xometry, Inc. (NASDAQ:XMTR) has a market capitalization of $1.478 billion.

Alger Weatherbie Specialized Growth Fund made the following comment about Xometry, Inc. (NASDAQ:XMTR) in its Q4 2022 investor letter:

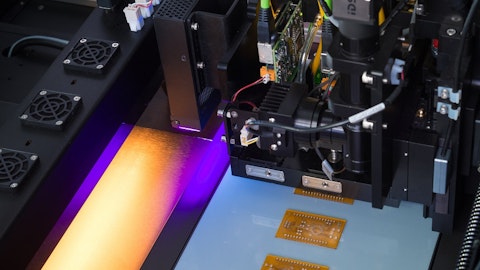

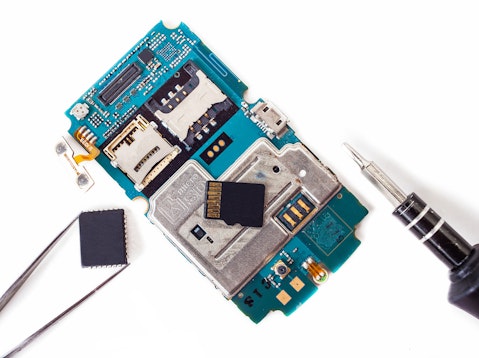

“Xometry, Inc. (NASDAQ:XMTR) is a leader in the digital evolution of industrial manufacturing through its proprietary software platform that enables product designers and engineers to instantly access the capacity of a global network of manufacturing facilities. The company operates throughout the US, but has a growing presence in Europe and Asia During the period, the company reported inline fiscal third quarter revenues but beat expectations on EPS However, management lowered fiscal fourth quarter and 2023 forward guidance as they saw a step change in supplier activity. The company noted that suppliers accepted orders quicker than usual on the Xometry platform due to a slower macroeconomic environment, which led to the proprietary algorithm reducing market pricing, resulting in weaker revenue growth in the near term. While near-term revenue growth may stall, we remain confident in the long-term prospects of the business as company fundamentals remain intact.”

Oleksandr Lysenko/Shutterstock.com

Xometry, Inc. (NASDAQ:XMTR) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 25 hedge fund portfolios held Xometry, Inc. (NASDAQ:XMTR) at the end of the fourth quarter which was 24 in the previous quarter.

We discussed Xometry, Inc. (NASDAQ:XMTR) in another article and shared the list of tech stocks to sell according to Cathie Wood. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.