Aristotle Capital Boston, LLC, an investment advisor, released its “Small Cap Equity Strategy” first quarter 2025 investor letter. A copy of the letter can be downloaded here. The volatility observed in 2024 continued into the first quarter of 2025. The Russell 2000 Index experienced volatility in Q1 2025, losing -9.48% after a strong 2024. Due to uncertainty, geopolitical tensions, and a longer rate environment, February and March were challenging. In the first quarter, the strategy delivered a return of -7.34% net of fees (-7.20% gross of fees), outperforming the Russell 2000 Index’s -9.48% total return. For more information on the fund’s best picks in 2025, please check its top five holdings.

In its first-quarter 2025 investor letter, Aristotle Capital Small Cap Equity Strategy highlighted stocks such as Veeco Instruments Inc. (NASDAQ:VECO). Veeco Instruments Inc. (NASDAQ:VECO) develops, manufactures, sells, and supports semiconductor process equipment. The one-month return of Veeco Instruments Inc. (NASDAQ:VECO) was 18.44%, and its shares lost 46.85% of their value over the last 52 weeks. On May 15, 2025, Veeco Instruments Inc. (NASDAQ:VECO) stock closed at $21.26 per share with a market capitalization of $1.239 billion.

Aristotle Capital Small Cap Equity Strategy stated the following regarding Veeco Instruments Inc. (NASDAQ:VECO) in its Q1 2025 investor letter:

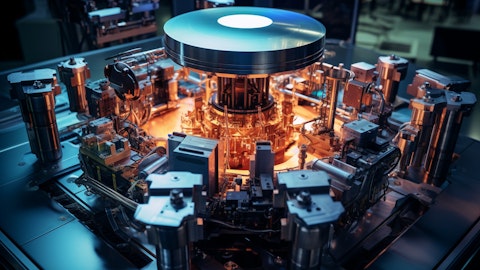

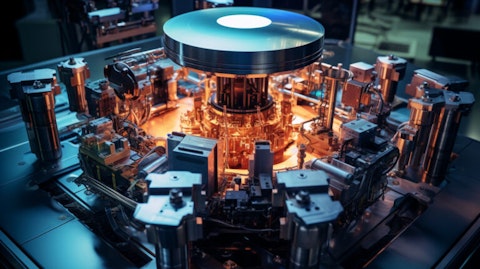

“Veeco Instruments Inc. (NASDAQ:VECO), engages in the development, manufacture, sale, and support of semiconductor process equipment. Its technologies consist of metal organic chemical vapor deposition, advanced packaging lithography, wet etch and clean, laser annealing, ion beam, molecular beam epitaxy, wafer inspection, and atomic layer deposition systems. The company should benefit from the evolution of the semiconductor chip as manufacturers seek new technologies to enhance the manufacturing process that will enable them to produce smaller and faster chips.”

A one of a kind semiconductor process equipment machine with various parts and components.

Veeco Instruments Inc. (NASDAQ:VECO) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 23 hedge fund portfolios held Veeco Instruments Inc. (NASDAQ:VECO) at the end of the fourth quarter which was 24 in the previous quarter. Veeco Instruments Inc. (NASDAQ:VECO) reported $167 million in revenue for Q1 2025, exceeding the midpoint of guidance. While we acknowledge the potential of Veeco Instruments Inc. (NASDAQ:VECO) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the undervalued AI stock set for massive gains.

In another article, we covered Veeco Instruments Inc. (NASDAQ:VECO) and shared the list of undervalued quantum computing stocks to buy. In addition, please check out our hedge fund investor letters Q1 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.