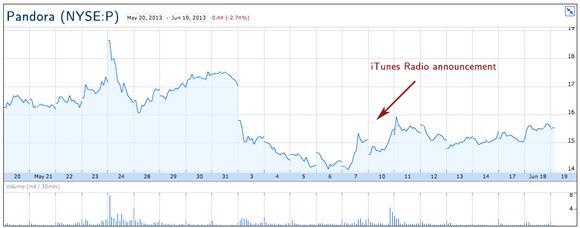

Investors long on Pandora Media Inc (NYSE:P) certainly did not take well to Apple Inc. (NASDAQ:AAPL)‘s announcement of a new Internet radio service, iTunes Radio, which took place last week at the WWDC Conference. With a much lower subscription fee ($24.99 per year), iTunes Radio is set to become a direct strong competitor.

Even worse, before the iTunes Radio announcement Pandora Media Inc (NYSE:P) was already starting to exhibit signals of slower growth in the number of listener hours. Considering that Pandora Media Inc (NYSE:P) was never consistently profitable due to a weak business model whose main costs are fixed royalty costs, will iTunes Radio become the straw that breaks the camel’s back? There is no signal that the stock’s downward momentum has increased after Apple Inc. (NASDAQ:AAPL)’s announcement so far, but this may be just the beginning.

Understanding Pandora

When I said that Pandora was never consistently profitable, I meant it. Pandora probably has the best technology to identify music that you could ask for, but the price they have to pay to maintain it is also among the highest. Let me show you why briefly:

Pandora Media Inc (NYSE:P) uses an algorithm called the “Music Genome Project” (MGP) which defines and organizes songs according to more than 450 attributes (categories, like “romantic,” “old fashioned” or “metal influences,” for example.) Every song is described by a vector containing these attributes up to various extends. Once a song is described, it is easy to make connections to similar songs in the database. The most important step is clearly the initial one, though: describing a song. This is, amazingly, done manually; a musician analyzes the song in a process that takes about half an hour.

This lets Pandora achieve top quality, but high-quality products come at a price. Pandora needs at least 30 minutes to describe a song, and 10% of the songs that are described will be revised by more than one person. Since there are about a million songs in the database and the number keeps growing, Pandora needs an army of music analysts to keep itself in the game. Furthermore, in order to stream the songs, Pandora needs to pay huge amounts of money in royalties. Just in the first 10 months of 2012, Pandora Media Inc (NYSE:P) paid $182.1 million in music royalties, or 60% of its revenue. By this time you should have noticed that Pandora’s business is not scalable or cost efficient at all; by adding more music to the database, the company won’t enjoy economies of scale here.

More competitors are joining the party

As Internet music streaming becomes more and more popular, many believe that eventually royalties will decrease. This is already happening, as Pandora’s content acquisition costs declined 400 basis points year-over-year to 64% of revenue. By 2015, the company hopes to participate actively in royalty negotiations.

The upside to this is that it could improve the margins of every company in this business, including Pandora. The downside is that it is also an invitation to competitors!

Because of dropping royalty costs, many competitors are joining the party. Currently there are about 30 companies in the world offering a similar service (including Spotify, Tuneln Radio and Last.fm) and the list may get bigger as royalties decrease. Each of these services has its own set of “unique features” to differentiate its product, but the truth is that with so many services it is hard to believe in pricing power. By charging one of the highest annual fees in the industry ($36 per year), Pandora will find it difficult to keep its premium price in the next years.

Pandora Media Inc (NYSE:P) is already facing the consequences of increasing competition. Let me show you Pandora’s key audience metrics for 2013:

| Month | January | February | March | April | May |

| Listening Hours (YoY growth) | 47% | 42% | 40% | 24% | 22% |

| Active Listeners (YoY growth) | 38% | 37% | 36% | 35% | 33% |

| Share of US Radio | 8.03% | 8.48% | 8.05% | 7.33% | 7.29% |

While listening hours and active listeners are still growing, the growth rate has been cut in half in just five months.

Implications of the iTunes Radio

Pandora was already in a challenging market position before Apple Inc. (NASDAQ:AAPL)’s announcement. Could a new competitor have come at a worse time?

Even worse, this is not a startup. This is Apple Inc. (NASDAQ:AAPL), who already has 500 million users and a stable, ubiquitous payments ecosystem. The product is also very competitive. iTunes Radio will be quite similar to Pandora, including a free version with ads and an ad-free version. To make matters worse, the subscription fee for iTunes Radio ($24.99 per year) is lower than that for Pandora ($36 per year).

Galileo Russell from Seeking Alpha explains the implications in a very clear way: Imagine that only 5% of Pandora’s users shift to Apple’s service. This is about 3.5 million people and enough for Pandora Media Inc (NYSE:P)’s active listeners to decline sequentially.

Google Inc (NASDAQ:GOOG) also joins the game!

Not only Apple Inc. (NASDAQ:AAPL) is interested in a business with potentially lower royalty fees. Google Inc (NASDAQ:GOOG) just launched an on-demand music subscription service called “Google Play Music All Access” a month ago. It features millions of songs that you can play instantly, including recommendations and radio stations. However, its current fee of $9.99 per month (U.S. price) is much higher than what Pandora or Apple charge.

Since there is no “free version” here, Google’s new service may not become an imminent risk. It also seems that Google may be interested in something more than revenue. On-demand music services have become a critical part in any smartphone, and Google Inc (NASDAQ:GOOG) may be searching just to strengthen its presence on mobile devices by adding this feature to the Android .

The bottom line

Pandora Media Inc (NYSE:P) is the leader in Internet radio but it is not making money due to high royalty fees and its cost-inefficient way of adding more music to its database. Royalty fees may keep decreasing as online music streaming becomes more popular, but this is also an invitation to competitors. Although there are more than 30 competitors worldwide, Pandora should take special attention to Apple Inc. (NASDAQ:AAPL)’s iTunes Radio and the Google Play Music All Access service. These two products could have a strong negative effect on Pandora’s user growth and also potential future margins.

The article Will Apple’s iTunes Radio Launch Stop Pandora’s Growth? originally appeared on Fool.com and is written by Adrian Campos.

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple and Google. Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.