There were 659 hedge funds in our system whose 13F portfolios on June 30 consisted of at least 5 long positions in billion-dollar companies. Of those 659 funds, an impressive 627 of them delivered positive returns during the third-quarter from their long positions in those stocks, based on the size of those positions on June 30. All told, their long picks in billion-dollar companies averaged 8.3% returns for the quarter, well above the S&P 500 ETFs’ 3.3% figure. Nonetheless, hedge funds continue to disappoint their investors for the most part, as redemptions have hit the industry hard of late. That can be chalked up to their high fees and the underperformance on the short-side of their portfolios, which provide downside protection but have dragged down overall returns. We recommend investors consider hedge funds’ long stock picks for their market-beating potential and will share four of them in this article, which were in the portfolio of Garelick Capital on June 30. They are Stamps.com Inc. (NASDAQ:STMP), Himax Technologies, Inc. (ADR) (NASDAQ:HIMX), Mellanox Technologies, Ltd. (NASDAQ:MLNX), and HubSpot Inc (NYSE:HUBS).

Garelick Capital Partners, L.P. is a Massachusetts-based hedge fund founded by Bruce J. Garelick. The firm manages a $130.67 million equity portfolio as of June 30 and its long positions returned 18.24% in the third quarter when looking at its 23 long positions in companies whose market capitalization was at least $1 billion on June 30. Insider Monkey’s research has proven that hedge funds’ long portfolio positions generally post positive returns, unlike the funds’ actual returns, which are lagging the market these days amid losses from the short side of their portfolios. We believe that one can beat the market by focusing on the long positions of famous hedge funds. Now then, let’s analyze Garelick Capital’s top picks which contributed to the fund’s overall performance in Q3.

Garelick Capital Partners reported ownership of over 1.54 million shares of Himax Technologies, Inc. (ADR) (NASDAQ:HIMX) as of the end of the second quarter, which shows a 54% increase in the fund’s holding in the company. The aggregate value of this updated position wa worth over $12.72 million on June 30. The stock returned 5.5% during the third quarter.

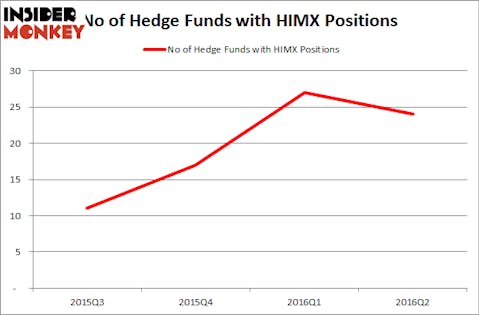

However, smart money managers were reducing their bets on the stock. The number of long hedge fund bets retreated by three to 24 in Q2. Among these funds, Prince Street Capital Management held the most valuable stake in Himax Technologies, Inc. (ADR) (NASDAQ:HIMX), which was worth $24.8 million at the end of the second quarter. On the second spot was Quentec Asset Management which amassed $22 million worth of shares. Moreover, Millennium Management and Shannon River Fund Management were also bullish on Himax Technologies, Inc. (ADR) (NASDAQ:HIMX).

Follow Himax Technologies Inc (NASDAQ:HIMX)

Follow Himax Technologies Inc (NASDAQ:HIMX)

Receive real-time insider trading and news alerts

Garelick Capital Partners upped its stake in Mellanox Technologies, Ltd. (NASDAQ:MLNX) by 43% in the second quarter, ending the period with a total of 177,105 shares of the company, which had a total worth of about $8.49 million. The stock lost 9.8% during the third quarter. Heading into the third quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, an 11%drop from the previous quarter. The largest stake in Mellanox Technologies, Ltd. (NASDAQ:MLNX) was held by Citadel Investment Group, which reported holding $80.4 million worth of stock as of the end of June. It was followed by Renaissance Technologies with a $37.6 million position. Other investors bullish on the company included Alyeska Investment Group, Shannon River Fund Management, and Kingdon Capital.

Follow Mellanox Technologies Ltd. (NASDAQ:MLNX)

Follow Mellanox Technologies Ltd. (NASDAQ:MLNX)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

Garelick Capital Partners added HubSpot Inc (NYSE:HUBS) as a new position to its portfolio in the second quarter, buying 187,120 Class A shares of the company, which had a total worth of $8.12 million at the end of June. This was a high-yielding investment for the firm, as the stock returned 32.7% during the third quarter. At Q2’s end, a total of 19 of the hedge funds in our system were long this stock, up by 12% from one quarter earlier. More specifically, Whale Rock Capital Management was the largest shareholder of HubSpot Inc (NYSE:HUBS), with a stake worth $28.2 million reported as of the end of June. Trailing Whale Rock Capital was Polar Capital, which amassed a stake valued at $22.1 million. Light Street Capital, Calixto Global Investors, and Folger Hill Asset Management also held valuable positions in the company.

Follow Hubspot Inc (NYSE:HUBS)

Follow Hubspot Inc (NYSE:HUBS)

Receive real-time insider trading and news alerts

Stamps.com Inc. (NASDAQ:STMP) was also a new arrival into Garelick Capital’s portfolio in the second quarter, as the fund acquired 90,087 shares of the company during the period, with an aggregate value of over $7.87 million. The stock returned 8.1% during the third quarter. At Q2’s end, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in Stamps.com, a 7% decline from one quarter earlier. The largest stake in Stamps.com Inc. (NASDAQ:STMP) was held by Columbus Circle Investors, which reported holding $38.6 million worth of stock at the end of June. It was followed by Park West Asset Management with a $28.8 million position. Other investors bullish on the company included Portolan Capital Management, Shannon River Fund Management, and Harvest Capital Strategies.

Follow Stamps.com Inc (NASDAQ:STMP)

Follow Stamps.com Inc (NASDAQ:STMP)

Receive real-time insider trading and news alerts

Disclosure: None