On the positive side of things, we’ve got Encana Corporation (USA) (NYSE:ECA), whose stock has rallied by 20% after the company reported fourth quarter EPS of $0.13 on revenue of $1.03 billion yesterday, beating profit estimates by $0.12 per share but missing revenue expectations. The more notable news factoring into today’s move however was the company’s cuts to its workforce. Along with the quarterly results, Encana Corporation announced that it will cut about 20% of its workforce, targeting a $550 million reduction in spending. Further, it is planning $900 million-to-$1 billion in capex spending, a 55% reduction from its 2015 capital investment. During the fourth quarter, hedge fund ownership of Encana Corporation (USA) (NYSE:ECA) among those in our database slid to 26 from 27. Israel Englander’s Millennium Management owned 19.48 million Encana shares at the end of December.

Follow Encana Corp (NYSE:ECA)

Follow Encana Corp (NYSE:ECA)

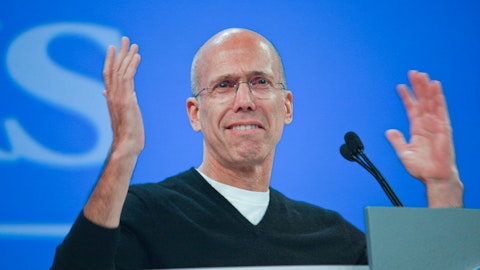

Receive real-time insider trading and news alerts

Dreamworks Animation Skg Inc (NASDAQ:DWA)’s shares are rallying by 17% today, continuing the bullish sentiment registered in yesterday’s after-hours trading after the animation studio reported strong revenue growth and better-than-expected fourth quarter results. For the fourth quarter, Dreamworks Animation reported EPS of $0.55 on revenue of $319.34 million, the latter being an increase of 36.3% year-over-year. Those results exceeded earnings estimates by a robust $0.39 per share and revenue estimates by $45.32 million. Of the 730 funds that we track, 13 of them owned 32.6% of Dreamworks Animation Skg Inc (NASDAQ:DWA)’s stock at the end of December. Among the funds long the stock is Mason Hawkins’ Southeastern Asset Management with a holding of 16.14 million shares.

Follow Dreamworks Animation Skg Inc. (NASDAQ:DWA)

Follow Dreamworks Animation Skg Inc. (NASDAQ:DWA)

Receive real-time insider trading and news alerts

Finally, there is Papa John’s Int’l, Inc. (NASDAQ:PZZA) whose shares are about 9% in the green after a profit beat in its latest financial results. For the fourth quarter, the Kentucky-based restaurant operator earned $0.62 per share on revenue of $416.82 million, beating estimates by $0.05 per share but missing on revenue by $8.94 million. The company’s management expects 2016 EPS of $2.30-to-$2.40 per share compared to the $2.38 figure Mr. Market is expecting. 17 funds reported ownership of Papa John’s Int’l, Inc. (NASDAQ:PZZA) shares as of the end of December. Among the believers is Jim Simons’ Renaissance Technologies, with a holding of 1.07 million shares at the end of 2015.

Follow Papa Johns International Inc (NASDAQ:PZZA)

Follow Papa Johns International Inc (NASDAQ:PZZA)

Receive real-time insider trading and news alerts

Disclosure: None