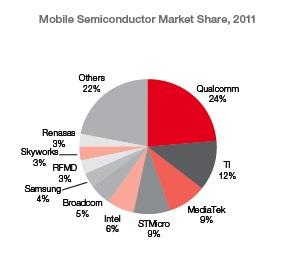

Economic moat around the company – Again, we are talking about a company that has a market worth of over $100 billion and over 57% share in the microprocessor chip market. Although Qualcomm (NASDAQ:QCOM) occupies around 24% share in the mobile semiconductor market, as last reported in 2011, one thing can set Qualcomm back. It does not have as strong a brand as Intel. Consumers buy electronic devices on the very premise that they use Intel’s chips. People trust and rely on the quality of Intel’s products. Intel’s revenue is governed mostly by its technologically sound and market ready products it manufactures. Do you think Intel might not be able to gain that in the mobile market as well?

On the other hand, I have strong conviction that Apple competes more on brand preference and design. It is basically the “coolness” factor that drives Apple’s revenue. Nonetheless, it will be harder (and more expensive) than most people think for Apple to remain as dominant as it is today.

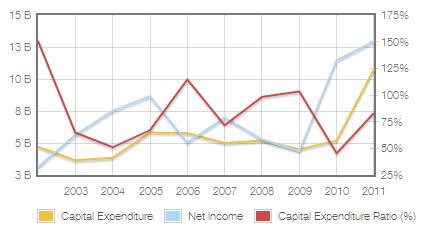

Moreover, the biggest entry barrier to the semiconductor industry is the amount of capital expenditure required for a full-fledged business. Intel’s research and development (R&D) expenditures were $8.4 billion in 2011 ($6.6 billion in 2010 and $5.7 billion in 2009). And with some new products in the pipeline, it might increase in 2013. Here is the capex ratio of Intel.

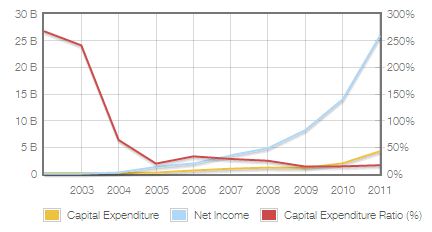

It stands well over a whopping 75%! In comparison to that, here is the capex ratio of Apple.

From the graph above, either Apple is not investing enough in its capital assets or the business it is in does not require high capital expenditure. In either case, lower capex requirement means lower economic moat for the company.

Return on shareholders’ equity – In 2012, Intel earned more than $20 billion in cash. With this huge profit, Intel spent more than $16 billion returning capital to its owners via cash dividends ($4 billion) and share buybacks ($12 billion). In other words, shareholders at Intel kept 80% of the profits. Doing the math, while Intel is worth $100 billion in the market, the current shareholder yield (including cash and share buyback) stands now at over 16%.

On the other hand, Apple earned $50 billion in cash last year. How much was returned to shareholders? Almost nothing, considering the huge cash hoard of around $137 billion – the shareholders got only $4.5 billion in total dividends (cash and net share buybacks). The company retained more than 90% of its earnings. With Apple’s market value around $420 billion, the current shareholder yield (including cash and share buyback) stands now around 1%.

In addition to that, let us take a look at the technical price chart of Intel.

Conclusion

While Intel might not be the market’s favorite at the moment, it might be a folly to overlook the potential of the stock at this moment. Remember Warren Buffett’s famous rule of thumb: Buy when others are selling; sell when others are buying.

With a severely oversold market condition, strong fundamentals, and solid revenue growth potential, Intel just might turn out to be a growth stock disguised as a value stock.

The article Why Intel Might be a Better Investment Than Apple originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.