Social investing refers to picking investments that provide good financial results as well as a positive effect on society. A lot of millennials are motivated to invest in companies that have values similar to theirs. In addition, they wish to get strong returns from their investments.

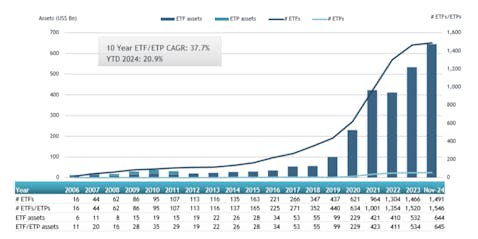

Because all positions are Contracts for Difference, traders can go long or short, using leverage that can magnify both profits and losses, and manage exposure with margin calls and stop-loss orders. This model has helped democratize access to ESG strategies: as per ETFGI, ESG-themed ETFs held approximately US$68 billion in assets with US$ $14.3 billion in inflows in early 2020 alone. By the end of 2024, ESG ETF AUM had grown to US$ 645 billion, with US$ 53.7 billion in net inflows so far this year. Nevertheless, asset-growth figures reflect historical inflows only and do not guarantee future demand or investment outcomes. Past performance is not a reliable indicator of future results.”

So why should hedge funds care about this trend? There are a few key reasons.

The Rise of Retail Investors

Currently, about a quarter of all U.S. stock trading is carried out by retail investors, which is twice as much as it was ten years ago. As meme stocks keep surging, some new traders are trying to affect the market by teaming up on social media. Social trading platforms can gather huge sums of money from individual traders in just a short time, allowing them to rotate capital quickly between meme names and benchmark products like the Hong Kong 50 Index when sentiment shifts.

In the past, hedge funds targeted institutional investors, but now, due to more retail investment, this approach is not enough. Being alert to popular social investing trends on the rise may show new business possibilities.

For example, survey data shows women and millennials are especially interested in values-based investing. As these demographics gain greater investing power, funds that address their preferences may be better positioned to attract capital, although no financial benefit is assured.

Demographics driving the social investing movement:

- Millennials. Motivated by long-term climate and ethical concerns

- Gen Z. Highly active on social platforms; expect transparency

- Women. More likely to invest based on values and impact

- First-time Investors. Seeking community validation and purpose

- Socially Aware Professionals. Align investing with personal ethics

The ESG Investing Boom

Taking environmental, social, and governance (ESG) factors into account when investing used to be only for those concerned about trees, but now it is for everyone. An area that was once small is now a major player, as more than $35 trillion in global assets now use ESG principles.

As we face more climate change worries, promote diversity, and enact more rules, ESG matters are now relevant in almost every industry. Those who don’t acknowledge these points may find themselves experiencing risks in their portfolios.

At the same time, tracking ESG trends in today’s diverse industries is not always easy. At this point, retail investors’ opinions on social media can be very helpful. A public survey on which companies are trusted by consumers could be used together with in-house reviews of sustainability.

For example, when social media users highlight ESG lapses at a fast-fashion brand, citing harmful materials or labor practices, hedge funds armed with the platform’s CFD trading tools can quickly short the stock via CFDs instead of buying shares outright. They can scale their position with leverage, set precise stop-loss or guaranteed stop orders to guard against sudden reversals, and respond to margin call alerts in real time. This agility can help funds adjust exposure rapidly; however, swift price gaps or liquidity shortages may still lead to material losses.

Alpha From Attention Metrics

Hedge funds try to discover new reasons for outperforming the market that are not related to common factors like general risk. Since data continues to grow, we are seeing valuable information in digital engagement and attention.

Some CFD platforms track attention metrics – profile follows, comment volume, and “share” recommendations – across its social feed. Traders using the CFD app can overlay these indicators on their charting workspace, then execute margin-based CFD trades with one click. As “meme mania” proved, sudden viral interest can trigger sharp price swings; by monitoring these social signals and responding with leveraged CFD orders (while carefully managing margin requirements and risk limits), hedge funds can attempt to exploit short-lived price dislocations while accepting the heightened risk of sharp reversals.

While such retail-driven moves tend to be temporary, they nonetheless create exploitable alpha opportunities for savvy institutional traders. Systematically incorporating attention metrics into quantitative models may improve risk-adjusted decision-making for short-term strategies, but positive results are not guaranteed. The ability to detect an emerging viral stock or theme early can be valuable, yet it remains uncertain and difficult to achieve consistently.

Additionally, prolonged retail interest in specific ESG funds or sustainability-focused companies may signal underlying growth prospects, though such signals can also prove misleading.

Big Data for Alpha Research

Modern markets are overwhelmed with complex data. Making sense of it requires sophisticated analytics and AI. Hedge funds spend heavily on acquiring alternative data sets to feed trading algorithms, often focusing on arcane indicators like satellite imagery of store parking lots.

Yet easy access to the thoughts and actions of millions of investors had been elusive…until now. Trusted platforms provide a portal into retail investor behavior and discussions unfolding across social media. The data created contains valuable signals, often eclipsing traditional sources in scale.

Adding a stream of grassroots opinions and trends into quantitative models opens new avenues for alpha research. Techniques like natural language processing and sentiment analysis can help algorithmically interpret loosely structured text at scale.

Furthermore, the collective wisdom of retail crowds on trading platforms may help assess speculative manias or spot overhyped stocks. While hedge funds have teams of researchers, more eyes and input could always be beneficial for idea generation or risk monitoring.

Catering to Growing Interests

While hedge funds need to deliver performance, they also need to attract capital in a competitive industry to grow assets under management. As wealthy individuals and family offices increasingly prioritize ESG mandates and social impact, funds that can speak to these interests will have an edge.

Offering products specifically targeting socially conscious investors has proven successful for traditional funds. For example, Morgan Stanley launched a sustainable equity fund in 2019, which attracted over $20 billion in inflows by the end of 2020 through its broader suite of sustainable funds. Now the world’s largest sustainable fund, it shows that principles and profits can, in fact, co-exist.

Boutique hedge funds focused on gender lens or faith-based investing have also grown rapidly in recent years. Yet, comprehensive ESG and social value integration across the over $3.8 trillion global hedge fund space is still limited. More can be done to expand options for clients, aligning finances with personal values.

Furthermore, showcasing engagement in special communities demonstrates commitment to sustainability initiatives, appealing to investors, especially helpful for smaller managers trying to stand out. Being involved rather than dismissive of social investing trends can earn goodwill with increasingly vocal retail activists.

Risks to Consider

While the growth of social investing platforms creates opportunities, it inevitably brings risks to manage as well. Some key issues hedge funds should be aware of include:

Herding Behavior and Bubbles

When investors with the same strategies come together online, the risk of herd behavior and bubbles goes up. When there are more traders in the same position, it increases the chance of volatility. Some people make profits in bubbles, but there is a risk of huge losses from pushing things too far. It is crucial to keep risk control and diversification in practice.

Misinformation Spread

It is well known that social networks can quickly make misinformation and “fake news” go viral. Social media does not match the level of fact-checking that formal media outlets use. Hedge funds should make sure they know the truth about market-shifting information, for example, rumors about a short squeeze.

Private Data Leakage

By design, social investing platforms facilitate the sharing of personal opinions and positions. However, safeguards are still maturing. Hedge funds participating in such platforms should be careful of accidentally leak proprietary strategies or assets. Enforcing strict internal guidelines on social media conduct is prudent.

Reputation Risk

As activism and public scrutiny of the finance sector increase, hedge funds need to carefully manage public perception and media relations. Viral outrage over any perceived unethical behavior can quickly damage a brand. Hedge funds should educate employees on best practices when engaging online to avoid potential PR disasters.

Looking Ahead

Social investing is expected to get bigger over the next few years, as millennials spend more and climate change is constantly talked about. Even though adopting social responsibility in investments is not easy, the advantages are significant, and so hedge funds should include it in their activities.

We are now living in a time when retail investors really influence the financial markets. The resulting data set can inform differentiated research and risk-management decisions, although it offers no assurance of superior returns. Adapting to new sources of data quickly will help fund managers beat competitors who have not changed their ways.

Conclusion

All in all, these platforms give individual investors the opportunity to collectively help causes like sustainability and diversity by making their investments through the markets. Because of this grassroots effort, more and more investors are interested in making a difference and getting positive returns.

To keep up, hedge funds should let online retail crowds point out new opportunities and manage risks that may appear. Getting data from investor opinions, positions, and attention signals by using big data analytics helps in generating better ideas, detecting emerging trends, watching for risks, and researching alpha.

Even though herding, misleading information, and privacy concerns are risks, most hedge funds still enjoy greater benefits from being part of communities. With millennials and women becoming wealthier in the next years, funds that focus on social values and impact will gain more attention. Basically, using portfolio strategies that include grassroots social investing trends can strengthen a firm’s competitiveness.

Disclaimer

While social-investing trends present analytical insights and potential opportunities, they also involve significant risks, including leverage-amplified losses, misinformation, and rapid sentiment shifts. Nothing in this article constitutes personalized investment advice, and past performance is not a reliable indicator of future results.