U.S stocks are mixed in Wednesday trading, as investors await the Fed’s decision on monetary policy. Among the stocks posting large moves in both directions today are Akamai Technologies, Inc. (NASDAQ:AKAM), Molson Coors Brewing Company (NYSE:TAP), Cemex SAB de CV (ADR) (NYSE:CX), Level 3 Communications, Inc. (NYSE:LVLT), and State Street Corp (NYSE:STT). Let’s take a look into the events behind the movement in these stocks and see what the hedge funds in our database think about the companies involved.

We believe that imitating hedge funds and other large institutional investors can be helpful in identifying stocks capable of outperforming the broader market. Through extensive research that covered portfolios of several hundred large investors between 1999 and 2012, we determined that following the small-cap stocks that large money managers are collectively bullish on, can generate monthly returns nearly 1.0 percentage points above the market (see more details here).

Nonwarit/Shutterstock.com

Akamai Plummets On Revenue Miss, Customer Concerns

Let’s start with Akamai Technologies, Inc. (NASDAQ:AKAM), which has plummeted by more than 16.6% in Wednesday trading following the announcement of the company’s second quarter results. While EPS of $0.64 was in-line with the Street’s expectations, revenue of $572 million missed estimates by $2.86 million. Also weighing on the stock were concerns about the company’s clients turning toward in-house solutions, to the detriment of external sources like Akamai.

As of the end of the first quarter, 31 funds among those we track held long positions in Akamai Technologies, Inc. (NASDAQ:AKAM). One of the largest shareholders was David Blood and Al Gore’s Generation Investment Management, which started a position comprising 5.1 million shares during the quarter.

Follow Akamai Technologies Inc (NASDAQ:AKAM)

Follow Akamai Technologies Inc (NASDAQ:AKAM)

Receive real-time insider trading and news alerts

Molson Coors Slips On Sympathy Dive

Next up is Molson Coors Brewing Company (NYSE:TAP), which was down by 5.7% on Wednesday afternoon on reports that SABMiller plc (ADR) (OTCMKTS:SBMRY) has stopped integration tasks with Anheuser Busch Inbev SA (ADR) (NYSE:BUD). While the deal hasn’t been scuttled, the mere possibility of such an outcome would be a blow to Molson Coors, which is set to acquire SABMiller’s stake in the MillerCoors brewing venture as part of that deal going down.

52 funds in our database were long Molson Coors Brewing Company (NYSE:TAP) at the end of March. Among them was First Eagle Investment Management, which disclosed ownership of 3.24 million Molson Coors shares worth more than $311 million in stock as of March 31.

Follow Molson Coors Beverage Co (NYSE:TAP)

Follow Molson Coors Beverage Co (NYSE:TAP)

Receive real-time insider trading and news alerts

We’ll run through the volatile performance of three other stocks today on the next page.

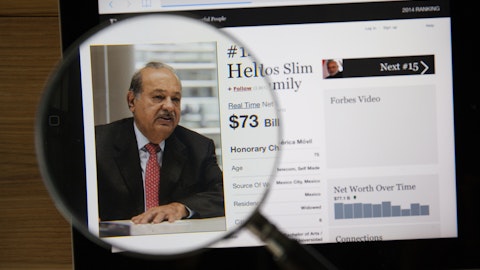

Cemex Spikes On Strong Q2 Results

Shares of Cemex SAB de CV (ADR) (NYSE:CX) are trading up by 4.3% this afternoon, driven by the announcement of the company’s second quarter results. Before the market opened, the Mexican company reported net income of $205 million, which was almost double the Street’s consensus estimate, and the firm’s highest total in roughly eight years, on revenue of $3.7 billion. Behind the strong performance were higher operating profits and robust sales in the U.S and Mexico, the company’s largest markets. Over the first quarter of 2016, the number of money managers in our database with equity investments in Cemex SAB de CV (ADR) (NYSE:CX) doubled to 18.

Level 3 Down On Revenue Miss

Back to decliners, we’ve got Level 3 Communications, Inc. (NYSE:LVLT), which has dropped by 6.25% today, following its second quarter earnings report. While EPS of $0.53 came in $0.09 above the Street’s consensus, revenue of $2.06 billion, flat year-over-year, fell $20 million short of expectations. Level 3 Communications, Inc. (NYSE:LVLT) was held by 52 investors in our database on March 31, including Mason Hawkins’ Southeastern Asset Management, which held 30 million shares, valued at more than $1.58 billion.

Follow Level 3 Communications Inc (NYSE:LVLT)

Follow Level 3 Communications Inc (NYSE:LVLT)

Receive real-time insider trading and news alerts

Robust Results Boost State Street

Lastly we come to State Street Corp (NYSE:STT), which has gained almost 8% on Wednesday, helped by strong second quarter results posted before the bell rang. EPS of $1.46 beat the Street’s consensus by $0.20, while revenue of $2.68 billion was $30 million higher than expectations. Among the main drivers of the strong quarterly performance was a 2.8% decline in expenses, to $1.83 billion.

Among the funds that we track, 24 held long positions in State Street Corp (NYSE:STT) as of March 31, including Harris Associates, which held 7.68 million shares worth almost $450 million in stock.

Follow State Street Corp (NYSE:STT)

Follow State Street Corp (NYSE:STT)

Receive real-time insider trading and news alerts

Disclosure: Javier Hasse holds no interest in any of the securities or entities mentioned in this article.