Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 6 years and analyze what the smart money thinks of Asana Inc. (NYSE:ASAN) based on that data.

Hedge fund interest in Asana Inc. (NYSE:ASAN) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that ASAN isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Hubbell Incorporated (NYSE:HUBB), Erie Indemnity Company (NASDAQ:ERIE), and Everest Re Group Ltd (NYSE:RE) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Chase Coleman of Tiger Global

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s analyze the key hedge fund action surrounding Asana Inc. (NYSE:ASAN).

Do Hedge Funds Think ASAN Is A Good Stock To Buy Now?

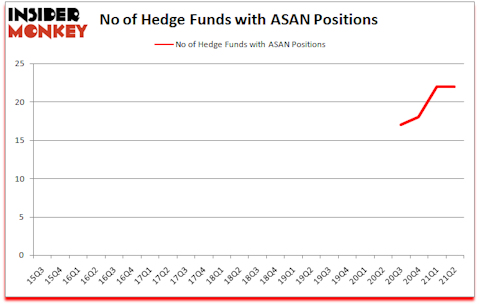

At the end of June, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ASAN over the last 24 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Tiger Global Management LLC was the largest shareholder of Asana Inc. (NYSE:ASAN), with a stake worth $178.7 million reported as of the end of June. Trailing Tiger Global Management LLC was Generation Investment Management, which amassed a stake valued at $155.2 million. 12 West Capital Management, Citadel Investment Group, and Whetstone Capital Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position 12 West Capital Management allocated the biggest weight to Asana Inc. (NYSE:ASAN), around 5.96% of its 13F portfolio. Whetstone Capital Advisors is also relatively very bullish on the stock, designating 4.43 percent of its 13F equity portfolio to ASAN.

Seeing as Asana Inc. (NYSE:ASAN) has witnessed bearish sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few hedgies who were dropping their full holdings last quarter. Intriguingly, Anand Parekh’s Alyeska Investment Group dumped the largest investment of the “upper crust” of funds tracked by Insider Monkey, worth close to $9.5 million in stock, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners was right behind this move, as the fund dropped about $7.5 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Asana Inc. (NYSE:ASAN) but similarly valued. We will take a look at Hubbell Incorporated (NYSE:HUBB), Erie Indemnity Company (NASDAQ:ERIE), Everest Re Group Ltd (NYSE:RE), Gerdau SA (NYSE:GGB), Robert Half International Inc. (NYSE:RHI), Jones Lang LaSalle Inc (NYSE:JLL), and Proofpoint Inc (NASDAQ:PFPT). This group of stocks’ market values resemble ASAN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HUBB | 15 | 459124 | 0 |

| ERIE | 15 | 48433 | 3 |

| RE | 30 | 686253 | -2 |

| GGB | 17 | 318478 | 6 |

| RHI | 23 | 281889 | -4 |

| JLL | 31 | 1554013 | 11 |

| PFPT | 48 | 2591761 | 26 |

| Average | 25.6 | 848564 | 5.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.6 hedge funds with bullish positions and the average amount invested in these stocks was $849 million. That figure was $592 million in ASAN’s case. Proofpoint Inc (NASDAQ:PFPT) is the most popular stock in this table. On the other hand Hubbell Incorporated (NYSE:HUBB) is the least popular one with only 15 bullish hedge fund positions. Asana Inc. (NYSE:ASAN) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ASAN is 45.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on ASAN as the stock returned 116.1% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Asana Inc. (NYSE:ASAN)

Follow Asana Inc. (NYSE:ASAN)

Receive real-time insider trading and news alerts

Suggested Articles:

- 11 Best Lithium and Battery Stocks To Buy

- 10 Best Roth IRA Stocks To Buy

- 25 U.S. cities most vulnerable to climate change

Disclosure: None. This article was originally published at Insider Monkey.