Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Kohl’s Corporation (NYSE:KSS).

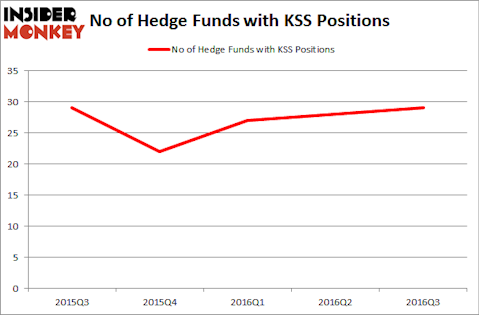

Is Kohl’s Corporation (NYSE:KSS) a buy here? Prominent investors are betting on the stock. The number of bullish hedge fund bets moved up by one during the third quarter and KSS was in 29 hedge funds’ portfolios at the end of September. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Oaktree Capital Group LLC (NYSE:OAK), NVR, Inc. (NYSE:NVR), and Apartment Investment and Management Co. (NYSE:AIV) to gather more data points.

Follow Kohls Corp (NYSE:KSS)

Follow Kohls Corp (NYSE:KSS)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

qvist/Shutterstock.com

Keeping this in mind, we’re going to view the key action encompassing Kohl’s Corporation (NYSE:KSS).

How have hedgies been trading Kohl’s Corporation (NYSE:KSS)?

Heading into the fourth quarter of 2016, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, up by 4% from the second quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Balyasny Asset Management, managed by Dmitry Balyasny, holds the number one position in Kohl’s Corporation (NYSE:KSS). Balyasny Asset Management has a $49 million position in the stock, comprising 0.3% of its 13F portfolio. The second largest stake is held by Israel Englander of Millennium Management, with a $48.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other professional money managers that are bullish encompass David Harding’s Winton Capital Management, Joel Greenblatt’s Gotham Asset Management, and Cliff Asness’ AQR Capital Management.