Is GlaxoSmithKline plc (ADR) (NYSE:GSK) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They fail miserably sometimes but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

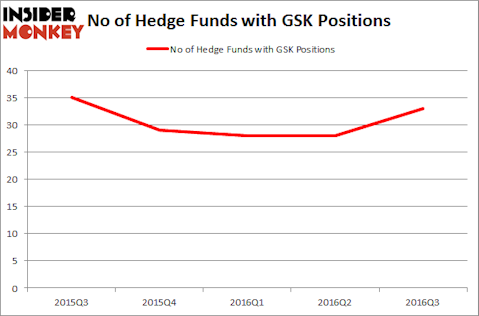

In GSK’s case, it looks like the best stock pickers are in a bullish mood. The number of investors bullish on the stock increased by five to 33 between July and September. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as CVS Caremark Corporation (NYSE:CVS), AbbVie Inc (NYSE:ABBV), and Schlumberger Limited. (NYSE:SLB) to gather more data points.

Follow Glaxosmithkline Plc (NYSE:GSK)

Follow Glaxosmithkline Plc (NYSE:GSK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

With all of this in mind, let’s check out the new action regarding GlaxoSmithKline plc (ADR) (NYSE:GSK).

How have hedgies been trading GlaxoSmithKline plc (ADR) (NYSE:GSK)?

As stated previously, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on GlaxoSmithKline at the end of September, a change of 18% from the end of the second quarter of 2016. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Fisher Asset Management, led by Ken Fisher, holds the most valuable position in GlaxoSmithKline plc (ADR) (NYSE:GSK). Fisher Asset Management has a $511.6 million position in the stock, comprising 0.9% of its 13F portfolio. The second largest stake is held by Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, which owns a $195.4 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish comprise John W. Rogers’ Ariel Investments, John Osterweis’ Osterweis Capital Management, and Jim Simons’ Renaissance Technologies.

As aggregate interest increased, key money managers have jumped into GlaxoSmithKline plc (ADR) (NYSE:GSK) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the biggest position in GlaxoSmithKline plc (ADR) (NYSE:GSK). Marshall Wace LLP had $33.8 million invested in the company at the end of the quarter. Thomas Bailard’s Bailard Inc also made a $10.7 million investment in the stock during the quarter. The other funds with brand new GSK positions are Ken Griffin’s Citadel Investment Group, Paul Cantor, Joseph Weiss, and Will Wurm’s Beech Hill Partners, and Mike Vranos’ Ellington.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as GlaxoSmithKline plc (ADR) (NYSE:GSK) but similarly valued. We will take a look at CVS Caremark Corporation (NYSE:CVS), AbbVie Inc (NYSE:ABBV), Schlumberger Limited. (NYSE:SLB), and Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT). All of these stocks’ market caps are closest to GSK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVS | 58 | 2005455 | 4 |

| ABBV | 56 | 4170340 | -1 |

| SLB | 59 | 1564821 | 4 |

| NTT | 10 | 182797 | -1 |

As you can see these stocks had an average of 46 hedge funds that reported long positions and the average amount invested in these stocks was $1.98 billion. That figure was $1.09 billion in GSK’s case. Schlumberger Limited. (NYSE:SLB) is the most popular stock in this table. On the other hand Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT) is the least popular one with only 10 bullish hedge fund positions. GlaxoSmithKline plc (ADR) (NYSE:GSK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Schlumberger Limited. (NYSE:SLB) might be a better candidate to consider a long position.