Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Vocera Communications Inc (NYSE:VCRA).

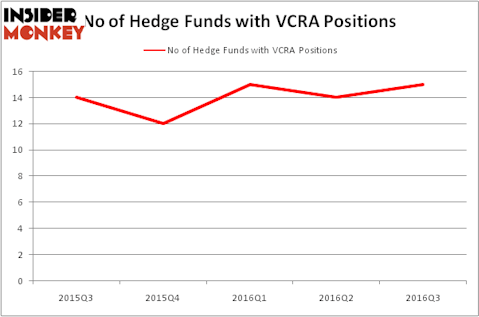

Vocera Communications Inc (NYSE:VCRA) was in 15 hedge funds’ portfolios at the end of September. VCRA investors should be aware of an increase in hedge fund interest lately. There were 14 hedge funds in our database with VCRA holdings at the end of the previous quarter. At the end of this article we will also compare VCRA to other stocks including FRP Holdings Inc (NASDAQ:FRPH), Kandi Technolgies Corp. (NASDAQ:KNDI), and NQ Mobile Inc (ADR) (NYSE:NQ) to get a better sense of its popularity.

Follow Vocera Communications Inc. (NYSE:VCRA)

Follow Vocera Communications Inc. (NYSE:VCRA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

What have hedge funds been doing with Vocera Communications Inc (NYSE:VCRA)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a 7% uptick from the previous quarter, as hedgie ownership of VCRA remains stable. By comparison, 12 hedge funds held shares or bullish call options in VCRA heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Renaissance Technologies, founded by Jim Simons, holds the number one position in Vocera Communications Inc (NYSE:VCRA). Renaissance Technologies has a $17.9 million position in the stock. On Renaissance Technologies’ heels is Manatuck Hill Partners, led by Mark Broach, which holds a $8.5 million position; the fund has 3.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions contain Principal Global Investors’ Columbus Circle Investors, Richard Driehaus’ Driehaus Capital, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.