ClearBridge Investments, an investment management company, released its “ClearBridge Select Strategy” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. U.S. equities strongly rebounded in the second quarter. The S&P 500 Index returned 10.9%, and the benchmark Russell 3000 Index advanced 11.0%, as risk-on sentiment took hold following the pause in tariff implementation. The strategy outperformed the benchmark in the quarter, driven by the strength in portfolio construction across companies and sectors with distinct growth drivers. In addition, please check the fund’s top five holdings to know its best picks in 2025.

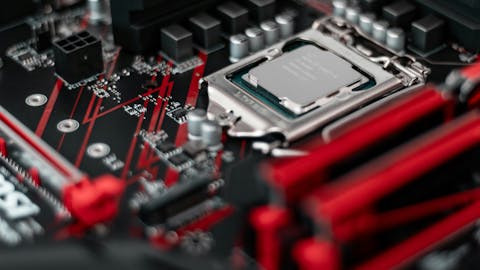

In its second-quarter 2025 investor letter, ClearBridge Select Strategy highlighted stocks such as Lattice Semiconductor Corporation (NASDAQ:LSCC). Lattice Semiconductor Corporation (NASDAQ:LSCC) develops and distributes semiconductor products. The one-month return of Lattice Semiconductor Corporation (NASDAQ:LSCC) was 8.76%, and its shares gained 23.33% of their value over the last 52 weeks. On September 17, 2025, Lattice Semiconductor Corporation (NASDAQ:LSCC) stock closed at $66.92 per share, with a market capitalization of $9.161 billion.

ClearBridge Select Strategy stated the following regarding Lattice Semiconductor Corporation (NASDAQ:LSCC) in its second quarter 2025 investor letter:

“We exited Monolithic Power Systems in the IT sector, rolling the proceeds into newer semiconductor additions, Lattice Semiconductor Corporation (NASDAQ:LSCC) and Qorvo. Lattice makes programable logic devices used in a wide range of applications including PC/servers, industrial, automotive and communications equipment. The volumes in most of its end markets have been depressed since the 2022 supply chain shock, but we believe declines have stabilized and volumes should start to grow late this year into 2026. Lattice is the best positioned company in the industry, taking share from other players through innovation, and its new CEO delivered remarkable returns for investors at a prior company owned in the Select portfolio.”

Lattice Semiconductor Corporation (NASDAQ:LSCC) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 34 hedge fund portfolios held Lattice Semiconductor Corporation (NASDAQ:LSCC) at the end of the second quarter, compared to 39 in the previous quarter. While we acknowledge the risk and potential of Lattice Semiconductor Corporation (NASDAQ:LSCC) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Lattice Semiconductor Corporation (NASDAQ:LSCC) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Lattice Semiconductor Corporation (NASDAQ:LSCC) and shared Artisan Mid Cap Fund’s views on the company. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.