Artisan Partners, an investment management company, released its “Artisan Value Fund” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. Equity markets faced significant volatility in the second quarter, fueled by the announcement and subsequent pause of the “Liberation Day” tariffs. Against this backdrop, the fund’s Investor Class ARTLX, Advisor Class APDLX, and Institutional Class APHLX returned 5.99%, 5.96%, and 5.96%, respectively, in the second quarter compared to a 3.79% return for the Russell 1000® Value Index. In addition, you can check the top 5 holdings of the strategy to know its best picks in 2025.

In its second-quarter 2025 investor letter, Artisan Value Fund highlighted stocks such as Lam Research Corporation (NASDAQ:LRCX). Lam Research Corporation (NASDAQ:LRCX) designs, manufactures, markets, refurbishes, and services semiconductor processing equipment. The one-month return of Lam Research Corporation (NASDAQ:LRCX) was 1.40%, and its shares gained 18.64% of their value over the last 52 weeks. On August 20, 2025, Lam Research Corporation (NASDAQ:LRCX) stock closed at $99.15 per share, with a market capitalization of $125.486 billion.

Artisan Value Fund stated the following regarding Lam Research Corporation (NASDAQ:LRCX) in its second quarter 2025 investor letter:

“Booking Holdings and Lam Research Corporation (NASDAQ:LRCX) were the top contributors in the consumer discretionary and information technology sectors, respectively. Lam Research is a global leader in wafer fabrication equipment used in the production of semiconductors. Lam was a new purchase, made on April 9 near depths of the post-Liberation Day market selloff. As value investors, conditions of fear and uncertainty are fertile ground for creating attractive long-term buying opportunities. Few areas of the market were under greater pressure than semiconductors & semiconductor equipment stocks to start the year. We had been researching Lam since 2023, so we knew the company well and were able to act quickly when the stock plunged. At our initial purchase, Lam was selling for ~$60, almost 50% below its July 2024 highs. Lam is one of the key global suppliers of chip equipment serving the memory (NAND and DRAM) and foundry/logic markets. The financial condition is rock solid as it has a net cash balance sheet, and the company returns 100% of earnings to shareholders via share repurchases and dividends. Shares were selling for a 17X P/E on cyclically depressed earnings at the time of initial purchase, which we believed was an attractive valuation given the compounding nature of the business.”

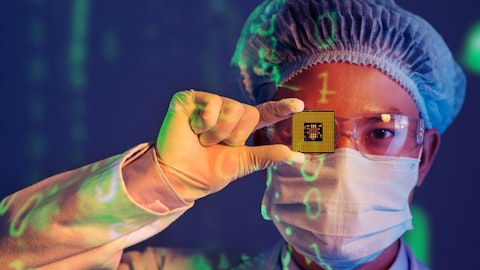

A technician operating an automated semiconductor processing machine with laser accuracy.

Lam Research Corporation (NASDAQ:LRCX) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 91 hedge fund portfolios held Lam Research Corporation (NASDAQ:LRCX) at the end of the first quarter, which was 84 in the previous quarter. In the June quarter, Lam Research Corporation (NASDAQ:LRCX) reported revenue of $5.17 billion, representing an increase of 10% from prior quarter. While we acknowledge the risk and potential of Lam Research Corporation (NASDAQ:LRCX) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Lam Research Corporation (NASDAQ:LRCX) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Lam Research Corporation (NASDAQ:LRCX) and shared the list of top tech stocks with strong return on equity. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.