Upslope Capital Management, an investment management company, released its fourth-quarter 2025 investor letter. A copy of the letter can be downloaded here. Upslope aims to provide attractive, equity-like returns while reducing market risk and keeping low correlation with traditional equity strategies. The fourth quarter marked a strong end to an exceptional year for the firm. The Fund delivered strong results with reduced downside risk. The Fund returned +2.0% (net) in Q4 compared to +1.6% for both the S&P Midcap 400 ETF (MDY) and HFRX Equity Hedge Index. For the year 2025, the Fund returned +14.8% compared to +7.2% and +10.1% returns for the indexes, respectively. The firm observed that markets are increasingly dynamic, and most investment decisions are driven by aggressive, thematic, and very short-term-focused strategies. As a closing note, the letter states that identifying investment opportunities is straightforward, but returns remain uncertain given the current economic landscape. In addition, you can check the Fund’s top five holdings to determine its best picks for 2025.

In its fourth-quarter 2025 investor letter, Upslope Capital Management highlighted stocks such as Crown Holdings, Inc. (NYSE:CCK). Headquartered in Tampa, Florida, Crown Holdings, Inc. (NYSE:CCK) operates in the packaging business and has recently been added to the portfolio. On January 16, 2026, Crown Holdings, Inc. (NYSE:CCK) stock closed at $104.24 per share. One-month return of Crown Holdings, Inc. (NYSE:CCK) was 1.02%, and its shares gained 21.83% of their value over the last 52 weeks. Crown Holdings, Inc. (NYSE:CCK) has a market capitalization of around $12.131 billion.

Upslope Capital Management stated the following regarding Crown Holdings, Inc. (NYSE:CCK) in its fourth quarter 2025 investor letter:

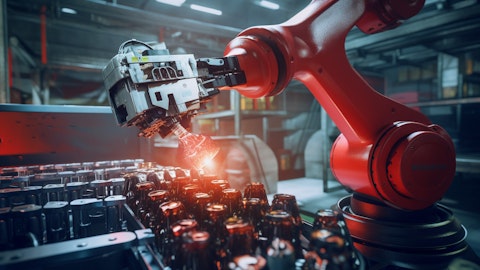

“Crown Holdings, Inc. (NYSE:CCK) is a leading global producer of aluminum beverage cans (80% of sales) and transit packaging/equipment (20%). The company is highly diversified by geography, with 60% of sales generated outside of the United States and 34% from emerging and frontier markets. Upslope has been both long and short (e.g. following a misguided acquisition that management seems to have learned the right lessons from) in the past.

While defensive stocks have been extremely out of favor for some time, Crown has continued to execute well, seeing steady growth and positive earnings revisions. As a result of this and the unfavorable environment for defensives, shares have remained cheap at just 13x earnings and 8x EBITDA (the latter effectively sitting near 10-year lows). At the same time, leverage (2.5x net) and share count (-15% in 5 years) are also at decade lows. This – a cheap, economically defensive stock with healthy secular trends, balance sheet optionality, and an active buyback – seems like a particularly attractive setup for a market environment marked by high macro uncertainty and aggressive valuations.

Key risks for the company and shares include: FX (most of sales are outside of the US), volume headwinds for beer/soda end markets, commodity pressure (generally pass throughs are tight, but occasionally issues pop up), and cyclical risk for the transit packaging unit.”

Crown Holdings, Inc. (NYSE:CCK) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 43 hedge fund portfolios held Crown Holdings, Inc. (NYSE:CCK) at the end of the third quarter, compared to 50 in the previous quarter. While we acknowledge the risk and potential of Crown Holdings, Inc. (NYSE:CCK) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Crown Holdings, Inc. (NYSE:CCK) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Crown Holdings, Inc. (NYSE:CCK) and shared the list of undervalued cyclical stocks to invest in. In addition, please check out our hedge fund investor letters Q4 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.