VF Corp is becoming interesting because it is slowly coming into value range, while I think Discover Financial Services (NYSE:DFS)’s underperformance is a buying opportunity; I picked some up last month. The credit cycle is back and Discover has been growing loans. I think it is the right strategy, and the company will be rewarded for doing so. There are some headwinds because of older loans maturing and net interest margin pressures, but history suggests that when household wealth expands (as it is doing now) and employment increases then consumers will start lending again. I think there is upside here.

As for the other ‘caution’ stocks there isn’t really a theme here. Intel Corporation (NASDAQ:INTC) has its challenges managing the migration to tablets/mobile, but it is starting to look like good value now. If it can stabilize gross margins and stop downgrading top line guidance the stock can go much higher. We shall see.

With PepsiCo, Inc. (NYSE:PEP) I’m a great believer that management should ignore the market and just do what they think is right. However, in this case I’m with the market! Pepsico has some very powerful brands that it is not realizing the value of. The market seems to be whispering ‘break up, break up, split’ in Pepsico’s ear and this isn’t just about investment bankers tarting around trying to get fees. Emerging markets are different, and companies need strong product focus rather than a sprawling empire of products across all geographies. Moreover, nobody fills their kitchen with Pepsi products in order to do the company a favor or because they like everything Pepsi. They do it because of product innovation, marketing and quality. This requires focus.

Becoming Interesting?

McCormick & Company, Incorporated (NYSE:MKC) is a bit like Family Dollar in some ways. It is defensive growth, but everybody knows it and has bid the stock up to such an evaluation that any hiccup will hurt investors. It recently guided below market estimates and the stock has fallen a bit. My previous view was that its industrial sales were slowing and much of the growth on the consumer side was due to acquisitions. This led me to suspect that market estimates for revenue growth were too high, and thus it has proved to be. Now that more realistic growth targets are being priced in, the stock is worth looking at.

Costco Wholesale Corporation (NASDAQ:COST) has been performing very well but, again, this is a story of a quality stock on a premium rating. I like the company, and note how its gross margins are improving. The ‘trade-off’ of volume growth versus losing margin, or vice versa, seems to have stopped, and Costco looks set to expand both volumes and margins. Moreover, others have managed to increase hard line margins (something Costco didn’t do in the last quarter), and with the global consumer electronic market appearing weak there must surely be good opportunity for margin expansion in the US for Costco.

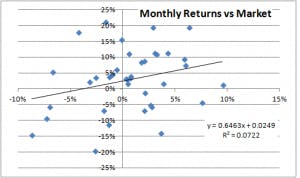

Finally, as promised above: You will note some hefty drawdown months, but it’s par for the course and overall I’m pleased with how things are going, particularly with the lack of correlation.

The article What I’ve Been Buying and Selling This Quarter originally appeared on Fool.com and is written by Lee Samaha.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.