Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

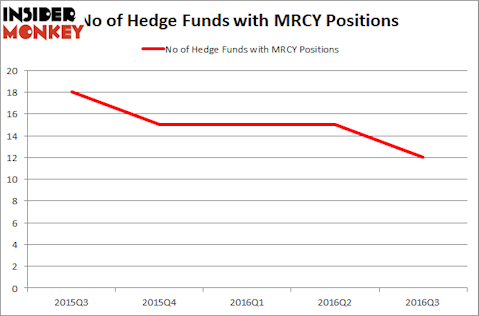

Mercury Systems Inc (NASDAQ:MRCY) investors should be aware of a decrease in support from the world’s most successful money managers lately. MRCY was in 12 hedge funds’ portfolios at the end of the third quarter of 2016. There were 15 hedge funds in our database with MRCY positions at the end of the previous quarter. At the end of this article we will also compare MRCY to other stocks including Luminex Corporation (NASDAQ:LMNX), State Auto Financial Corp (NASDAQ:STFC), and Scientific Games Corp (NASDAQ:SGMS) to get a better sense of its popularity.

Follow Mercury Systems Inc (NASDAQ:MRCY)

Follow Mercury Systems Inc (NASDAQ:MRCY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Egorov Artem/Shutterstock.com

Now, we’re going to analyze the new action encompassing Mercury Systems Inc (NASDAQ:MRCY).

How have hedgies been trading Mercury Systems Inc (NASDAQ:MRCY)?

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in MRCY over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, ACK Asset Management, led by Richard S. Meisenberg, holds the number one position in Mercury Systems Inc (NASDAQ:MRCY). ACK Asset Management has a $29 million position in the stock, comprising 8.8% of its 13F portfolio. On ACK Asset Management’s heels is Royce & Associates, led by Chuck Royce, which holds a $28.2 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other peers that hold long positions comprise Renaissance Technologies, one of the largest hedge funds in the world, D.E. Shaw’s D E Shaw, and Richard Driehaus’ Driehaus Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.