The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Euronav NV Ordinary Shares (NYSE:EURN) from the perspective of those successful funds.

Is Euronav NV Ordinary Shares (NYSE:EURN) a buy right now? It looks like money managers are reducing their bets on the stock. The number funds from our database long the stock declined by four during the third quarter. At the end of this article we will also compare EURN to other stocks including La-Z-Boy Incorporated (NYSE:LZB), Magnetek Inc(NASDAQ:MAG), and Opus Bank (NASDAQ:OPB) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zadorozhnyi Viktor/Shutterstock.com

Keeping this in mind, let’s take a look at the new action surrounding Euronav NV Ordinary Shares (NYSE:EURN).

How have hedgies been trading Euronav NV Ordinary Shares (NYSE:EURN)?

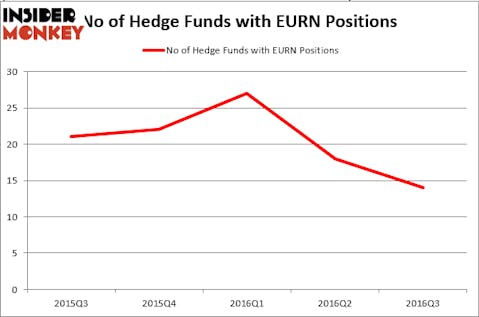

At the end of the third quarter, 14 funds tracked by Insider Monkey were long this stock, down by 22% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EURN over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Joe Huber’s Huber Capital Management holds the most valuable position in Euronav NV Ordinary Shares (NYSE:EURN). Huber Capital Management has a $30.2 million position in the stock, comprising 1.2% of its 13F portfolio. The second largest stake is held by Avenue Capital, led by Marc Lasry, holding a $19.8 million position; 4.2% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism contain Steve Cohen’s Point72 Asset Management, Anand Parekh’s Alyeska Investment Group, and Jim Simons’s Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Euronav NV Ordinary Shares (NYSE:EURN) has sustained bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few hedge funds who were dropping their entire stakes by the end of the third quarter. Intriguingly, George McCabe’s Portolan Capital Management dropped the biggest investment of all the hedgies monitored by Insider Monkey, comprising about $1.2 million in stock, and John Fichthorn’s Dialectic Capital Management was right behind this move, as the fund dumped about $0.9 million worth of shares.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Euronav NV Ordinary Shares (NYSE:EURN) but similarly valued. These stocks are La-Z-Boy Incorporated (NYSE:LZB), Magnetek Inc(NASDAQ:MAG), Opus Bank (NASDAQ:OPB), and Amplify Snack Brands Inc (NYSE:BETR). This group of stocks’ market caps are similar to EURN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LZB | 18 | 64304 | -1 |

| MAG | 13 | 51804 | 0 |

| OPB | 10 | 263294 | -3 |

| BETR | 5 | 13193 | -5 |

As you can see these stocks had an average of 12 funds with bullish positions and the average amount invested in these stocks was $98 million. That figure was $80 million in EURN’s case. La-Z-Boy Incorporated (NYSE:LZB) is the most popular stock in this table with 18 funds holding shares. On the other hand Amplify Snack Brands Inc (NYSE:BETR) is the least popular one with only five bullish hedge fund positions. Euronav NV Ordinary Shares (NYSE:EURN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard La-Z-Boy Incorporated (NYSE:LZB) might be a better candidate to consider taking a long position in.

Disclosure: none