Plum Creek Timber Co. Inc. (NYSE:PCL) owns over 6 million acres of American land and expects further growth, especially as the housing market rebounds. As proof, the firm recently announced a 5% quarterly cash dividend increase. When asked about the firm’s growth potential, CEO Rick Holley said, “Earnings and cash flow from our timber resources and manufacturing segments are rising and we’re expecting good follow-through in these trends for the remainder of the year. We’re excited about the opportunities that we see unfolding longer-term for our businesses and expect 2013 to create a solid base for growth in 2014 and beyond.”

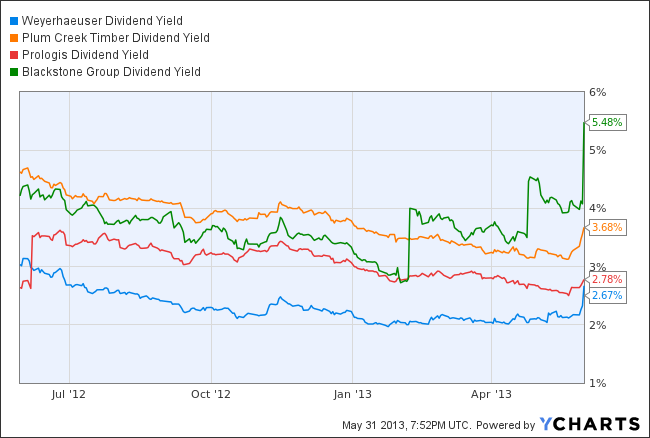

Plum Creek Timber Co. Inc. (NYSE:PCL)’s price has slipped about 8% just this past week. However, I recommend buying while it is still low. It will soar in coming weeks. And as you see below, Plum Creek Timber Co. Inc. (NYSE:PCL)’s 3.67% dividend yield is quite a nice perk, too.

WY Dividend Yield data by YCharts

Second, consider the market conditions. Productivity and profit result from investment and foresight. Therefore, we must ask why Morgan Stanley (NYSE:MS) is desperately trying to rebuild its real estate fund. In fact, the investment bank is preparing to raise between $1 and $3 billion for a global property fund.

Perhaps Morgan Stanley (NYSE:MS) is trying to jump on the bandwagon that private equity firms like The Blackstone Group L.P. (NYSE:BX) and REITs like Prologis Inc (NYSE:PLD) lead. The two firms recently announced that they will jointly purchase over 17 million square feet of warehouses for nearly $1 billion. The Blackstone Group L.P. (NYSE:BX) plans to operate just over 50% of the portfolio. Prologis Inc (NYSE:PLD) will manage the rest. Moving forward, consider Blackstone’s past successes and balance sheet.

As shown below, just Blackstone’s long-term investments could cover over 95% of the firm’s liabilities. Then, consider its other long- and short-term assets. It is well managed. Its dividend yield is phenomenal. Expect to see revenue growth in coming earnings releases.

| Blackstone | ||

|---|---|---|

| Long-Term Investments | $ 19,954,586 | |

| Cash and Cash Equivalents | $ 2,056,642 | |

| Total Liabilities | $ 20,862,613 |

Perhaps Prologis, which operated at a loss the past three years, recognizes that Blackstone may be on to something. I think this to be the case. With cash on hand and a new deal under its belt, Prologis could be laying the foundations to once again become profitable.

Such a deal sparks questions. For example, how much longer will real estate value continue to blossom? Is the “tipping point” around the corner? Frankly, I don’t know. However, if you want to earn some income while riding the wave, Weyerhaeuser Company (NYSE:WY), Plum Creek Timber Co. Inc. (NYSE:PCL), and even Blackstone are for you.

The article A Win-Win Scenario originally appeared on Fool.com.

Brendan Marasco has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Brendan is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.