Earnings and earning-related news is the number one catalyst for stock movement. A strong quarter can dictate the direction of a stock for the following three months as can a bad quarter; in the past I have written in detail about such subjects, a domino effect following a strong or bad quarter. However, sometimes the market gets it wrong, and stocks trend incorrectly. Therefore, I am looking at three big time post-earnings reactions to determine if any or all were fundamentally justified.

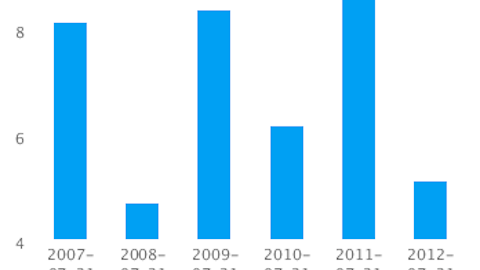

Daktronics, Inc. (NASDAQ:DAKT) has traded virtually flat for the last year. The volatile stock has had an unpredictable decade and has found it difficult to maintain momentum. On Tuesday, the volatile stock fell 9% after reporting earnings. The company posted revenue of $111.1 million, short of expectations by $12 million, yet met bottom line expectations. The stock’s losses were also sparked by the company’s drop in several segments of revenue, indicating weakness across the board.

While there were obvious weaknesses within the report, it’s important to remember that this is by no means an expensive stock; and that an investment in Daktronics returns a dividend yield of more than 2%. Although the revenue miss caught the headlines, investors might want to take notice that net profit for the quarter rose 63%, which was partially due to lower costs. In addition, the company also noted that orders are currently higher across its business, including 62% oversees.

Therefore, this implies future growth, and that Daktronics may be presenting value. My guess is that if investors would’ve taken time to notice these facts, Daktronics might have traded considerably higher rather than lower.

Beyond the Top and Bottom Line Suggests Value

Group 1 Automotive, Inc. (NYSE:GPI) fell lower by 7.55% after reporting earnings. The company missed on the bottom line but beat on the top line. However, there was more to the quarter than top and bottom line numbers.

The company’s total gross profit grew 14% on 19.3% higher revenues. Furthermore, new vehicle revenues increased 22.3% on higher unit sales, almost 21% better sales. As you can see, there is a lot of positive from the earnings report, and with very attractive margins, you might want to consider using the report as an opportunity to buy.

Solid Beat but Was it Worth the Performance?

Shares of Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB) rallied almost 19% after the company posted its fifth quarterly beat in a row. The company solidly beat both top and bottom line expectations, with revenue growth of nearly 20%. The company also improved its efficiency, expanding margins by 0.7% to 20.6% and saw guest counts rise 0.3% and check prices rise another 1.1%. While all of these numbers are encouraging, and suggest further growth, it was most likely the company’s plan to open 20 new stores in 2013 compared to just three in 2012 that helped to shoot the stock higher.