We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Trane Technologies plc (NYSE:TT).

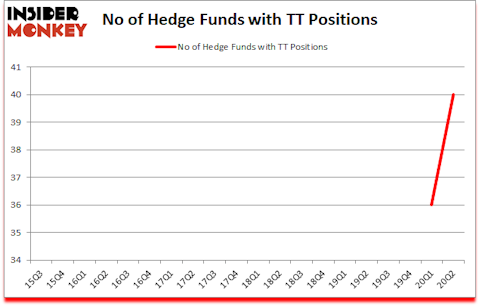

Trane Technologies plc (NYSE:TT) investors should pay attention to an increase in activity from the world’s largest hedge funds lately. Trane Technologies plc (NYSE:TT) was in 40 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 36. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 36 hedge funds in our database with TT positions at the end of the first quarter. Our calculations also showed that TT isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of signals market participants employ to assess publicly traded companies. Two of the most under-the-radar signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can trounce their index-focused peers by a very impressive amount (see the details here).

David Blood of Generation Investment Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind let’s take a glance at the fresh hedge fund action regarding Trane Technologies plc (NYSE:TT).

How are hedge funds trading Trane Technologies plc (NYSE:TT)?

At second quarter’s end, a total of 40 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the first quarter of 2020. On the other hand, there were a total of 0 hedge funds with a bullish position in TT a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Trane Technologies plc (NYSE:TT) was held by Generation Investment Management, which reported holding $297.1 million worth of stock at the end of June. It was followed by Impax Asset Management with a $91.2 million position. Other investors bullish on the company included Millennium Management, D E Shaw, and Adage Capital Management. In terms of the portfolio weights assigned to each position Ecofin Ltd allocated the biggest weight to Trane Technologies plc (NYSE:TT), around 1.8% of its 13F portfolio. Generation Investment Management is also relatively very bullish on the stock, earmarking 1.71 percent of its 13F equity portfolio to TT.

As one would reasonably expect, key money managers were breaking ground themselves. McKinley Capital Management, managed by Robert B. Gillam, initiated the most valuable position in Trane Technologies plc (NYSE:TT). McKinley Capital Management had $15.4 million invested in the company at the end of the quarter. Ray Dalio’s Bridgewater Associates also made a $4.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Louis Bacon’s Moore Global Investments, Benjamin A. Smith’s Laurion Capital Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Trane Technologies plc (NYSE:TT) but similarly valued. These stocks are TELUS Corporation (NYSE:TU), FleetCor Technologies, Inc. (NYSE:FLT), Aptiv PLC (NYSE:APTV), FirstEnergy Corp. (NYSE:FE), Simon Property Group, Inc (NYSE:SPG), Canon Inc. (NYSE:CAJ), and Equifax Inc. (NYSE:EFX). This group of stocks’ market valuations resemble TT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TU | 15 | 194956 | 0 |

| FLT | 53 | 2212169 | 2 |

| APTV | 43 | 1158307 | 10 |

| FE | 41 | 992017 | -3 |

| SPG | 27 | 531930 | -2 |

| CAJ | 9 | 55132 | 2 |

| EFX | 28 | 1186553 | -4 |

| Average | 30.9 | 904438 | 0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.9 hedge funds with bullish positions and the average amount invested in these stocks was $904 million. That figure was $730 million in TT’s case. FleetCor Technologies, Inc. (NYSE:FLT) is the most popular stock in this table. On the other hand Canon Inc. (NYSE:CAJ) is the least popular one with only 9 bullish hedge fund positions. Trane Technologies plc (NYSE:TT) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for TT is 74.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on TT as the stock returned 49.8% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Trane Technologies Plc (NYSE:TT)

Follow Trane Technologies Plc (NYSE:TT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.