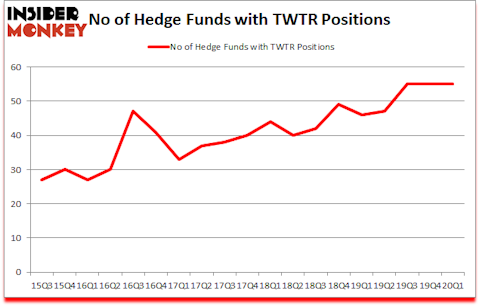

Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Twitter Inc (NYSE:TWTR) based on that data and determine whether they were really smart about the stock.

Twitter Inc (NYSE:TWTR) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 55 hedge funds’ portfolios at the end of the first quarter of 2020. At the end of this article we will also compare TWTR to other stocks including Ford Motor Company (NYSE:F), PT Telekomunikasi Indonesia (NYSE:TLK), and STMicroelectronics N.V. (NYSE:STM) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are perceived as unimportant, old investment vehicles of years past. While there are over 8000 funds with their doors open at the moment, We look at the bigwigs of this group, about 850 funds. These hedge fund managers command the lion’s share of all hedge funds’ total asset base, and by tracking their unrivaled equity investments, Insider Monkey has brought to light numerous investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Paul Singer of Elliott Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, this trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost gold prices. So, we are checking out this junior gold mining stock. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a look at the recent hedge fund action surrounding Twitter Inc (NYSE:TWTR).

How have hedgies been trading Twitter Inc (NYSE:TWTR)?

At the end of the first quarter, a total of 55 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2019. On the other hand, there were a total of 46 hedge funds with a bullish position in TWTR a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Coatue Management, managed by Philippe Laffont, holds the most valuable position in Twitter Inc (NYSE:TWTR). Coatue Management has a $163.1 million position in the stock, comprising 2.1% of its 13F portfolio. Coming in second is Appaloosa Management LP, managed by David Tepper, which holds a $135.8 million position; 4.2% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish include Ken Griffin’s Citadel Investment Group, John Smith Clark’s Southpoint Capital Advisors and Brett Barakett’s Tremblant Capital. In terms of the portfolio weights assigned to each position Empirical Capital Partners allocated the biggest weight to Twitter Inc (NYSE:TWTR), around 8.89% of its 13F portfolio. Harspring Capital Management is also relatively very bullish on the stock, dishing out 7.14 percent of its 13F equity portfolio to TWTR.

Seeing as Twitter Inc (NYSE:TWTR) has experienced declining sentiment from the smart money, logic holds that there was a specific group of hedge funds who sold off their positions entirely in the first quarter. At the top of the heap, Josh Resnick’s Jericho Capital Asset Management sold off the biggest investment of the 750 funds watched by Insider Monkey, comprising about $59.1 million in stock, and Karthik Sarma’s SRS Investment Management was right behind this move, as the fund said goodbye to about $48.1 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Twitter Inc (NYSE:TWTR). These stocks are Ford Motor Company (NYSE:F), PT Telekomunikasi Indonesia (NYSE:TLK), STMicroelectronics N.V. (NYSE:STM), and PPL Corporation (NYSE:PPL). This group of stocks’ market caps are closest to TWTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| F | 33 | 667079 | -3 |

| TLK | 7 | 151891 | -1 |

| STM | 11 | 70106 | -6 |

| PPL | 28 | 311688 | -4 |

| Average | 19.75 | 300191 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $300 million. That figure was $990 million in TWTR’s case. Ford Motor Company (NYSE:F) is the most popular stock in this table. On the other hand PT Telekomunikasi Indonesia (NYSE:TLK) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Twitter Inc (NYSE:TWTR) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still managed to beat the market by 15.5 percentage points. Hedge funds were also right about betting on TWTR, though not to the same extent, as the stock returned 21.3% in Q2 and outperformed the market as well.

Follow Twitter Inc. (NYSE:TWTR)

Follow Twitter Inc. (NYSE:TWTR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.