The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded IDEXX Laboratories, Inc. (NASDAQ:IDXX) based on those filings.

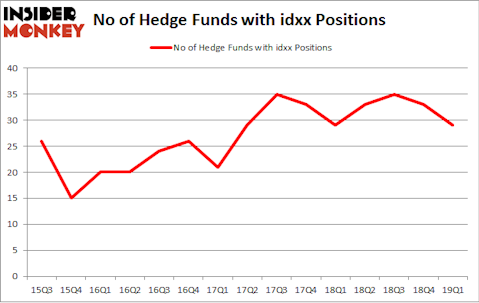

Is IDEXX Laboratories, Inc. (NASDAQ:IDXX) undervalued? Hedge funds are getting less bullish. The number of long hedge fund positions decreased by 4 recently. Our calculations also showed that idxx isn’t among the 30 most popular stocks among hedge funds. IDXX was in 29 hedge funds’ portfolios at the end of the first quarter of 2019. There were 33 hedge funds in our database with IDXX positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

Let’s take a gander at the key hedge fund action regarding IDEXX Laboratories, Inc. (NASDAQ:IDXX).

How are hedge funds trading IDEXX Laboratories, Inc. (NASDAQ:IDXX)?

Heading into the second quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from the fourth quarter of 2018. By comparison, 29 hedge funds held shares or bullish call options in IDXX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of IDEXX Laboratories, Inc. (NASDAQ:IDXX), with a stake worth $243.5 million reported as of the end of March. Trailing Renaissance Technologies was GLG Partners, which amassed a stake valued at $108.8 million. Arrowstreet Capital, AQR Capital Management, and Marshall Wace LLP were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that IDEXX Laboratories, Inc. (NASDAQ:IDXX) has faced falling interest from the aggregate hedge fund industry, logic holds that there is a sect of funds who were dropping their entire stakes last quarter. It’s worth mentioning that Richard Chilton’s Chilton Investment Company dumped the biggest position of all the hedgies tracked by Insider Monkey, comprising an estimated $50.7 million in stock, and Robert Pohly’s Samlyn Capital was right behind this move, as the fund dropped about $28.6 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 4 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to IDEXX Laboratories, Inc. (NASDAQ:IDXX). These stocks are Credicorp Ltd. (NYSE:BAP), Newmont Goldcorp Corporation (NYSE:NEM), Best Buy Co., Inc. (NYSE:BBY), and Essex Property Trust Inc (NYSE:ESS). This group of stocks’ market values are similar to IDXX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAP | 20 | 762470 | 6 |

| NEM | 35 | 787316 | 4 |

| BBY | 35 | 1130058 | 12 |

| ESS | 16 | 447378 | -3 |

| Average | 26.5 | 781806 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $782 million. That figure was $696 million in IDXX’s case. Newmont Goldcorp Corporation (NYSE:NEM) is the most popular stock in this table. On the other hand Essex Property Trust Inc (NYSE:ESS) is the least popular one with only 16 bullish hedge fund positions. IDEXX Laboratories, Inc. (NASDAQ:IDXX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on IDXX as the stock returned 11.7% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.