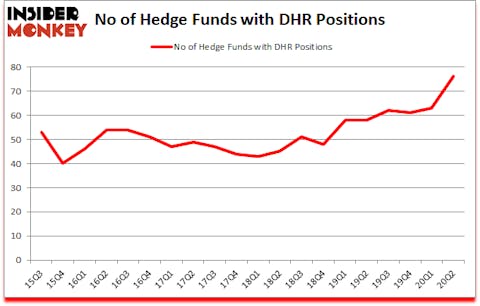

Danaher Corporation (NYSE:DHR) has experienced an increase in activity from the world’s largest hedge funds lately. Danaher Corporation (NYSE:DHR) was in 76 hedge funds’ portfolios at the end of June. The all time high for this statistics is 63. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 63 hedge funds in our database with DHR holdings at the end of March. Our calculations also showed that DHR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now we’re going to take a gander at the new hedge fund action regarding Danaher Corporation (NYSE:DHR).

What have hedge funds been doing with Danaher Corporation (NYSE:DHR)?

At the end of June, a total of 76 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 21% from one quarter earlier. By comparison, 58 hedge funds held shares or bullish call options in DHR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D1 Capital Partners, managed by Daniel Sundheim, holds the number one position in Danaher Corporation (NYSE:DHR). D1 Capital Partners has a $566.5 million position in the stock, comprising 4.2% of its 13F portfolio. The second most bullish fund manager is Dan Loeb of Third Point, with a $530.5 million position; the fund has 7.3% of its 13F portfolio invested in the stock. Remaining peers that hold long positions encompass Ken Fisher’s Fisher Asset Management, Charles Akre’s Akre Capital Management and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Sandell Asset Management allocated the biggest weight to Danaher Corporation (NYSE:DHR), around 13.09% of its 13F portfolio. Third Point is also relatively very bullish on the stock, setting aside 7.26 percent of its 13F equity portfolio to DHR.

Consequently, key money managers have been driving this bullishness. Viking Global, managed by Andreas Halvorsen, established the biggest position in Danaher Corporation (NYSE:DHR). Viking Global had $159.8 million invested in the company at the end of the quarter. Doug Silverman and Alexander Klabin’s Senator Investment Group also made a $79.6 million investment in the stock during the quarter. The following funds were also among the new DHR investors: Arthur B Cohen and Joseph Healey’s Healthcor Management LP, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Robert Pohly’s Samlyn Capital.

Let’s check out hedge fund activity in other stocks similar to Danaher Corporation (NYSE:DHR). We will take a look at Medtronic plc (NYSE:MDT), Royal Dutch Shell plc (NYSE:RDS), NextEra Energy, Inc. (NYSE:NEE), Texas Instruments Incorporated (NASDAQ:TXN), Union Pacific Corporation (NYSE:UNP), American Tower Corporation (NYSE:AMT), and Shopify Inc (NYSE:SHOP). This group of stocks’ market caps match DHR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDT | 58 | 2705363 | -1 |

| RDS | 34 | 1164812 | 6 |

| NEE | 55 | 1943660 | 3 |

| TXN | 55 | 2131731 | 9 |

| UNP | 68 | 3685933 | 5 |

| AMT | 61 | 4407292 | 4 |

| SHOP | 57 | 5916379 | 14 |

| Average | 55.4 | 3136453 | 5.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 55.4 hedge funds with bullish positions and the average amount invested in these stocks was $3136 million. That figure was $4288 million in DHR’s case. Union Pacific Corporation (NYSE:UNP) is the most popular stock in this table. On the other hand Royal Dutch Shell plc (NYSE:RDS) is the least popular one with only 34 bullish hedge fund positions. Compared to these stocks Danaher Corporation (NYSE:DHR) is more popular among hedge funds. Our overall hedge fund sentiment score for DHR is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 29.2% in 2020 through October 16th but still managed to beat the market by 19.7 percentage points. Hedge funds were also right about betting on DHR as the stock returned 28.7% since the end of June (through 10/16) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Danaher Corp (NYSE:DHR)

Follow Danaher Corp (NYSE:DHR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.