The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Resolute Forest Products Inc (NYSE:RFP).

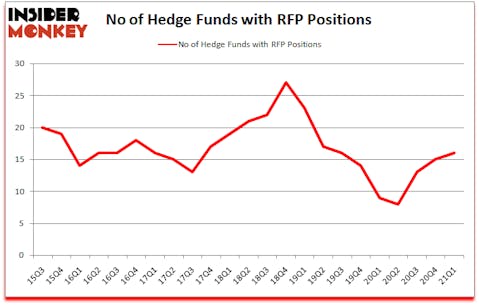

Resolute Forest Products Inc (NYSE:RFP) was in 16 hedge funds’ portfolios at the end of March. The all time high for this statistic is 27. RFP has seen an increase in enthusiasm from smart money in recent months. There were 15 hedge funds in our database with RFP holdings at the end of December. Our calculations also showed that RFP isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the eyes of most traders, hedge funds are seen as unimportant, old investment tools of the past. While there are over 8000 funds in operation at the moment, We choose to focus on the aristocrats of this group, around 850 funds. These investment experts watch over the majority of the smart money’s total capital, and by observing their first-class investments, Insider Monkey has come up with a few investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Francis Chou of Chou Associates Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to analyze the recent hedge fund action regarding Resolute Forest Products Inc (NYSE:RFP).

Do Hedge Funds Think RFP Is A Good Stock To Buy Now?

At the end of March, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in RFP over the last 23 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Fairfax Financial Holdings held the most valuable stake in Resolute Forest Products Inc (NYSE:RFP), which was worth $334.5 million at the end of the fourth quarter. On the second spot was Renaissance Technologies which amassed $7.8 million worth of shares. Chou Associates Management, Two Sigma Advisors, and PEAK6 Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Fairfax Financial Holdings allocated the biggest weight to Resolute Forest Products Inc (NYSE:RFP), around 11.67% of its 13F portfolio. Chou Associates Management is also relatively very bullish on the stock, earmarking 5.77 percent of its 13F equity portfolio to RFP.

Now, specific money managers were leading the bulls’ herd. PEAK6 Capital Management, managed by Matthew Hulsizer, created the most valuable call position in Resolute Forest Products Inc (NYSE:RFP). PEAK6 Capital Management had $4 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $0.8 million investment in the stock during the quarter. The following funds were also among the new RFP investors: Peter Muller’s PDT Partners, Gavin Saitowitz and Cisco J. del Valle’s Prelude Capital (previously Springbok Capital), and Kamyar Khajavi’s MIK Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Resolute Forest Products Inc (NYSE:RFP) but similarly valued. These stocks are World Acceptance Corp. (NASDAQ:WRLD), Quanex Building Products Corporation (NYSE:NX), NeoGames S.A. (NASDAQ:NGMS), Lakeland Bancorp, Inc. (NASDAQ:LBAI), Cryolife Inc (NYSE:CRY), Warrior Met Coal Inc. (NYSE:HCC), and The Aaron’s Company, Inc. (NYSE:AAN). This group of stocks’ market valuations match RFP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WRLD | 7 | 105380 | -4 |

| NX | 15 | 85585 | 2 |

| NGMS | 9 | 52946 | -5 |

| LBAI | 14 | 37223 | 2 |

| CRY | 8 | 56029 | -2 |

| HCC | 26 | 150464 | 1 |

| AAN | 18 | 69074 | -5 |

| Average | 13.9 | 79529 | -1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.9 hedge funds with bullish positions and the average amount invested in these stocks was $80 million. That figure was $367 million in RFP’s case. Warrior Met Coal Inc. (NYSE:HCC) is the most popular stock in this table. On the other hand World Acceptance Corp. (NASDAQ:WRLD) is the least popular one with only 7 bullish hedge fund positions. Resolute Forest Products Inc (NYSE:RFP) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for RFP is 47.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.5% in 2021 through July 23rd and still beat the market by 10.1 percentage points. Hedge funds were also right about betting on RFP, though not to the same extent, as the stock returned 16.5% since Q1 (through July 23rd) and outperformed the market as well.

Follow Resolute Forest Products Inc. (NYSE:RFP)

Follow Resolute Forest Products Inc. (NYSE:RFP)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Fast Food Companies Is The World

- 11 Best Pharma and Biotech Stocks To Buy

- 13 Biggest Gay Pride Parades in the World

Disclosure: None. This article was originally published at Insider Monkey.