Last year we predicted the arrival of the first US recession since 2009 and we told in advance that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Amcor plc (NYSE:AMCR).

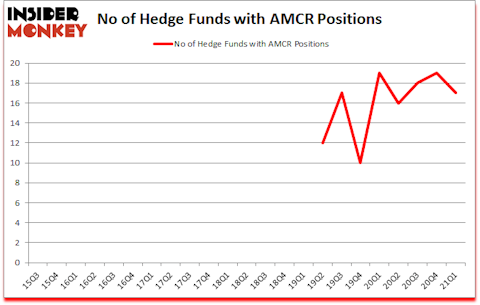

Amcor plc (NYSE:AMCR) was in 17 hedge funds’ portfolios at the end of March. The all time high for this statistic is 19. AMCR investors should pay attention to a decrease in support from the world’s most elite money managers recently. There were 19 hedge funds in our database with AMCR holdings at the end of December. Our calculations also showed that AMCR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 115 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to review the new hedge fund action encompassing Amcor plc (NYSE:AMCR).

Do Hedge Funds Think AMCR Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -11% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AMCR over the last 23 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Bernard Horn’s Polaris Capital Management has the number one position in Amcor plc (NYSE:AMCR), worth close to $166.4 million, corresponding to 5.5% of its total 13F portfolio. The second most bullish fund manager is Millennium Management, managed by Israel Englander, which holds a $19 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other professional money managers that are bullish include Phill Gross and Robert Atchinson’s Adage Capital Management, Ken Griffin’s Citadel Investment Group and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Polaris Capital Management allocated the biggest weight to Amcor plc (NYSE:AMCR), around 5.46% of its 13F portfolio. Tudor Investment Corp is also relatively very bullish on the stock, setting aside 0.07 percent of its 13F equity portfolio to AMCR.

Seeing as Amcor plc (NYSE:AMCR) has experienced bearish sentiment from the smart money, it’s easy to see that there is a sect of fund managers that decided to sell off their entire stakes in the first quarter. Interestingly, Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors dumped the largest investment of the 750 funds monitored by Insider Monkey, comprising an estimated $3.3 million in stock. David Harding’s fund, Winton Capital Management, also dropped its stock, about $1.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds in the first quarter.

Let’s also examine hedge fund activity in other stocks similar to Amcor plc (NYSE:AMCR). We will take a look at Caesars Entertainment Inc. (NASDAQ:CZR), Affirm Holdings, Inc. (NASDAQ:AFRM), Expeditors International of Washington, Inc. (NASDAQ:EXPD), Rogers Communications Inc. (NYSE:RCI), Invitation Homes Inc. (NYSE:INVH), SS&C Technologies Holdings, Inc. (NASDAQ:SSNC), and Catalent Inc (NYSE:CTLT). All of these stocks’ market caps are similar to AMCR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CZR | 76 | 1520267 | 5 |

| AFRM | 32 | 582516 | 32 |

| EXPD | 21 | 440396 | -4 |

| RCI | 18 | 289168 | 3 |

| INVH | 28 | 1174443 | 1 |

| SSNC | 54 | 2671021 | 5 |

| CTLT | 29 | 1016499 | -6 |

| Average | 36.9 | 1099187 | 5.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.9 hedge funds with bullish positions and the average amount invested in these stocks was $1099 million. That figure was $227 million in AMCR’s case. Caesars Entertainment Inc. (NASDAQ:CZR) is the most popular stock in this table. On the other hand Rogers Communications Inc. (NYSE:RCI) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Amcor plc (NYSE:AMCR) is even less popular than RCI. Our overall hedge fund sentiment score for AMCR is 29.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Hedge funds dodged a bullet by taking a bearish stance towards AMCR. Our calculations showed that the top 10 most popular hedge fund stocks returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.5% in 2021 through July 23rd but managed to beat the market again by 10.1 percentage points. Unfortunately AMCR wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was very bearish); AMCR investors were disappointed as the stock returned -2.3% since the end of the first quarter (through 7/23) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Amcor Plc (NYSE:AMCR)

Follow Amcor Plc (NYSE:AMCR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Energy Companies

- Billionaire John Paulson’s Top 10 Stock Picks

- 15 Most Expensive Alcohols in the World in 2021

Disclosure: None. This article was originally published at Insider Monkey.