In this article we are going to use hedge fund sentiment as a tool and determine whether Wells Fargo & Company (NYSE:WFC) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

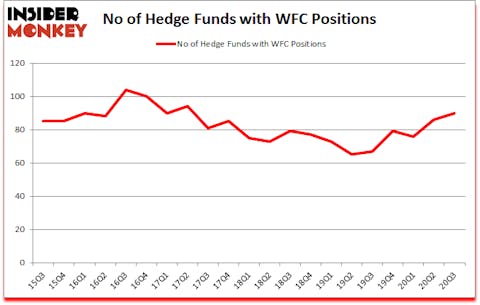

Wells Fargo & Company (NYSE:WFC) was in 90 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistics is 104. WFC investors should be aware of an increase in hedge fund sentiment of late. There were 86 hedge funds in our database with WFC holdings at the end of June. Our calculations also showed that WFC ranks 24th among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 66 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 13% through November 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s view the fresh hedge fund action regarding Wells Fargo & Company (NYSE:WFC).

Hedge fund activity in Wells Fargo & Company (NYSE:WFC)

Heading into the fourth quarter of 2020, a total of 90 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. By comparison, 67 hedge funds held shares or bullish call options in WFC a year ago. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Berkshire Hathaway, managed by Warren Buffett, holds the biggest position in Wells Fargo & Company (NYSE:WFC). Berkshire Hathaway has a $2.9947 billion position in the stock, comprising 1.3% of its 13F portfolio. Buffett cut his stake in WFC by 46% during the third quarter though. The second largest stake is held by Eagle Capital Management, led by Boykin Curry, holding a $1.1207 billion position; 4% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish comprise D. E. Shaw’s D E Shaw, Ken Griffin’s Citadel Investment Group and Richard S. Pzena’s Pzena Investment Management. In terms of the portfolio weights assigned to each position Magnolia Capital Fund allocated the biggest weight to Wells Fargo & Company (NYSE:WFC), around 23.44% of its 13F portfolio. Theleme Partners is also relatively very bullish on the stock, designating 13.32 percent of its 13F equity portfolio to WFC.

As aggregate interest increased, key hedge funds were breaking ground themselves. Windacre Partnership, managed by Snehal Amin, created the most outsized position in Wells Fargo & Company (NYSE:WFC). Windacre Partnership had $153.4 million invested in the company at the end of the quarter. John Petry’s Sessa Capital also initiated a $103 million position during the quarter. The other funds with brand new WFC positions are Jonathan Kolatch’s Redwood Capital Management, Farhad Nanji and Michael DeMichele’s MFN Partners, and Charles de Vaulx’s International Value Advisers.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Wells Fargo & Company (NYSE:WFC) but similarly valued. We will take a look at Advanced Micro Devices, Inc. (NASDAQ:AMD), GlaxoSmithKline plc (NYSE:GSK), Sony Corporation (NYSE:SNE), The Boeing Company (NYSE:BA), ServiceNow Inc (NYSE:NOW), 3M Company (NYSE:MMM), and HDFC Bank Limited (NYSE:HDB). This group of stocks’ market values match WFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMD | 71 | 5089177 | 20 |

| GSK | 31 | 1772408 | 3 |

| SNE | 26 | 369841 | -2 |

| BA | 43 | 1702712 | 4 |

| NOW | 82 | 5945474 | -4 |

| MMM | 56 | 1347738 | 14 |

| HDB | 34 | 1121313 | -8 |

| Average | 49 | 2478380 | 3.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49 hedge funds with bullish positions and the average amount invested in these stocks was $2478 million. That figure was $8467 million in WFC’s case. ServiceNow Inc (NYSE:NOW) is the most popular stock in this table. On the other hand Sony Corporation (NYSE:SNE) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Wells Fargo & Company (NYSE:WFC) is more popular among hedge funds. Our overall hedge fund sentiment score for WFC is 85. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 28.1% in 2020 through November 23rd but still managed to beat the market by 15.4 percentage points. Hedge funds were also right about betting on WFC as the stock returned 12.4% since the end of September (through 11/23) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Wells Fargo & Company (NYSE:WFC)

Follow Wells Fargo & Company (NYSE:WFC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.