We can judge whether Watsco Inc (NYSE:WSO) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, research shows that these picks historically outperformed the market when we factor in known risk factors.

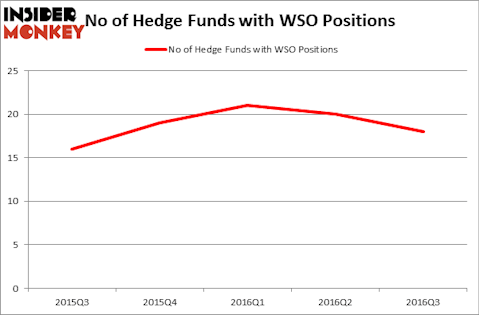

Is Watsco Inc (NYSE:WSO) a healthy stock for your portfolio? The smart money is getting less bullish. The number of long hedge fund investments shrunk by 2 recently. A total of 18 of the hedge funds in our system owned WSO shares at the end of September. There were 20 hedge funds in our database with WSO positions at the end of the June quarter. At the end of this article we will also compare WSO to other stocks including Orbital ATK Inc (NYSE:OA), Weatherford International Ltd (NYSE:WFT), and First Solar, Inc. (NASDAQ:FSLR) to get a better sense of its popularity.

Follow Watsco Inc (NYSE:WSO; WSOB)

Follow Watsco Inc (NYSE:WSO; WSOB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

PathDoc/Shutterstock.com

How have hedgies been trading Watsco Inc (NYSE:WSO)?

At the end of the third quarter, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a drop of 10% from the previous quarter, as hedge fund sentiment begins to trend down. 19 hedge funds held shares or bullish call options in WSO heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Israel Englander’s Millennium Management has the biggest position in Watsco Inc (NYSE:WSO), worth close to $50.2 million. On Millennium Management’s heels is Tom Gayner of Markel Gayner Asset Management, with a $25 million position. Remaining peers that are bullish encompass Greg Poole’s Echo Street Capital Management, Cliff Asness’ AQR Capital Management, and Jim Simons’ Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that Watsco Inc (NYSE:WSO) has weathered falling interest from the entirety of the hedge funds we track, we can see that there exists a select few hedgies who sold off their entire stakes heading into the fourth quarter. Interestingly, Phill Gross and Robert Atchinson’s Adage Capital Management got rid of the largest stake of the “upper crust” of funds watched by Insider Monkey, valued at close to $3.6 million in stock, and John A. Levin’s Levin Capital Strategies was right behind this move, as the fund said goodbye to about $1.1 million worth of shares.

Let’s check out hedge fund activity in other stocks similar to Watsco Inc (NYSE:WSO). We will take a look at Orbital ATK Inc (NYSE:OA), Weatherford International Ltd (NYSE:WFT), First Solar, Inc. (NASDAQ:FSLR), and Keysight Technologies Inc (NYSE:KEYS). This group of stocks’ market caps are similar to WSO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OA | 33 | 507862 | 1 |

| WFT | 31 | 587638 | 0 |

| FSLR | 23 | 245591 | -7 |

| KEYS | 14 | 144383 | -1 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $371 million. That figure was $160 million in WSO’s case. Orbital ATK Inc (NYSE:OA) is the most popular stock in this table. On the other hand Keysight Technologies Inc (NYSE:KEYS) is the least popular one with only 14 bullish hedge fund positions. Watsco Inc (NYSE:WSO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OA might be a better candidate to consider taking a long position in.

Disclosure: None