Stocks, especially the once high flying technology stocks, had a lousy start to the new year. QQQ lost 9% of its value in January. We aren’t certain about the bubbly technology stocks that trade for ridiculously high multiples of their revenues, but we believe top hedge fund stocks will deliver positive returns for the rest of the year. In this article, we will take a closer look at hedge fund sentiment towards RenaissanceRe Holdings Ltd. (NYSE:RNR) at the end of the third quarter and determine whether the smart money was really smart about this stock.

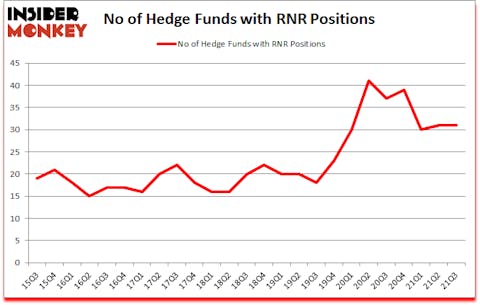

Hedge fund interest in RenaissanceRe Holdings Ltd. (NYSE:RNR) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that RNR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Brixmor Property Group Inc (NYSE:BRX), Skechers USA Inc (NYSE:SKX), and Planet Fitness Inc (NYSE:PLNT) to gather more data points.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s analyze the fresh hedge fund action regarding RenaissanceRe Holdings Ltd. (NYSE:RNR).

Do Hedge Funds Think RNR Is A Good Stock To Buy Now?

At Q3’s end, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. By comparison, 37 hedge funds held shares or bullish call options in RNR a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Southeastern Asset Management, managed by Mason Hawkins, holds the biggest position in RenaissanceRe Holdings Ltd. (NYSE:RNR). Southeastern Asset Management has a $126.7 million position in the stock, comprising 2.4% of its 13F portfolio. On Southeastern Asset Management’s heels is Polar Capital, led by Brian Ashford-Russell and Tim Woolley, holding a $125.4 million position; the fund has 0.5% of its 13F portfolio invested in the stock. Other peers that hold long positions encompass Gavin M. Abrams’s Abrams Bison Investments, Cliff Asness’s AQR Capital Management and Chuck Royce’s Royce & Associates. In terms of the portfolio weights assigned to each position BlueMar Capital Management allocated the biggest weight to RenaissanceRe Holdings Ltd. (NYSE:RNR), around 5.25% of its 13F portfolio. Soapstone Capital is also relatively very bullish on the stock, designating 3.44 percent of its 13F equity portfolio to RNR.

Because RenaissanceRe Holdings Ltd. (NYSE:RNR) has experienced bearish sentiment from the smart money, it’s safe to say that there exists a select few hedge funds who sold off their full holdings last quarter. Intriguingly, Matthew Stadelman’s Diamond Hill Capital dropped the largest investment of the 750 funds followed by Insider Monkey, comprising close to $56.3 million in stock. Israel Englander’s fund, Millennium Management, also dumped its stock, about $18.2 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to RenaissanceRe Holdings Ltd. (NYSE:RNR). These stocks are Brixmor Property Group Inc (NYSE:BRX), Skechers USA Inc (NYSE:SKX), Planet Fitness Inc (NYSE:PLNT), Change Healthcare Inc. (NASDAQ:CHNG), Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR), Virgin Galactic Holdings, Inc. (NYSE:SPCE), and Varonis Systems Inc (NASDAQ:VRNS). This group of stocks’ market valuations are similar to RNR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BRX | 24 | 246523 | 3 |

| SKX | 35 | 744486 | 0 |

| PLNT | 40 | 1515923 | 6 |

| CHNG | 50 | 1557603 | -1 |

| ARWR | 24 | 150783 | -6 |

| SPCE | 16 | 105669 | -2 |

| VRNS | 27 | 298396 | 3 |

| Average | 30.9 | 659912 | 0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.9 hedge funds with bullish positions and the average amount invested in these stocks was $660 million. That figure was $474 million in RNR’s case. Change Healthcare Inc. (NASDAQ:CHNG) is the most popular stock in this table. On the other hand Virgin Galactic Holdings, Inc. (NYSE:SPCE) is the least popular one with only 16 bullish hedge fund positions. RenaissanceRe Holdings Ltd. (NYSE:RNR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for RNR is 49.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Hedge funds were also right about betting on RNR as the stock returned 13% since the end of Q3 (through 1/31) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Renaissancere Holdings Ltd (NYSE:RNR)

Follow Renaissancere Holdings Ltd (NYSE:RNR)

Receive real-time insider trading and news alerts

Suggested Articles:

- Billionaire Nelson Peltz’s Top 8 Stock Picks

- 15 Largest Law Firms In The World

- 10 Best Auto Stocks to Buy Now

Disclosure: None. This article was originally published at Insider Monkey.